Did you know that nearly 70% of online shoppers abandon their carts and one of the main reasons is a poor or untrusted payment experience? In eCommerce, a reliable payment gateway does more than just process transactions; it builds trust, ensures security, and creates a smooth checkout flow that encourages customers to complete their purchases. For Shopify store owners, choosing the right payment gateway can directly impact conversion rates, customer satisfaction, and even international sales.

In this blog, we’ll cover the best payment gateways for Shopify, compare their features and fees, and walk you through how to integrate them into your store with ease. Whether you’re just starting out or looking to optimize your current setup, this guide will help you make the right choice.

Table of Contents

ToggleWhat is a Payment Gateway?

A payment gateway is a technology that securely transfers payment information from your Shopify store to the financial institutions involved in the transaction. Think of it as the virtual equivalent of a card machine at a physical store. It authorizes and processes payments made by customers using credit cards, debit cards, digital wallets, or other online payment methods.

When a customer checks out on your store, the payment gateway encrypts their data, validates their card details, checks for fraud, and communicates with the bank or payment processor to approve the transaction. Once approved, the payment is completed, and the order is confirmed.

Payment Gateway vs. Payment Processor

While the terms are often used interchangeably, they serve slightly different roles:

- A payment gateway is the front-end tech that captures and encrypts payment data.

- A payment processor handles the back-end communication between banks to move the money from the buyer’s account to the seller’s.

In many modern solutions (like Stripe or Shopify Payments), both roles are bundled together to simplify the setup.

Key Features to Look for in a Payment Gateway for Shopify:

- Seamless Shopify integration: Look for gateways that are directly supported or have reliable apps/plugins.

- Security compliance: PCI DSS compliance, SSL encryption, and fraud protection are must-haves.

- Multiple payment methods: Support for credit/debit cards, wallets, UPI, and Buy Now Pay Later (BNPL) options.

- Global currency and region support: Especially important if you serve international customers.

- Transparent pricing: Understand transaction fees, monthly costs, and any hidden charges.

- Fast payouts: A gateway that settles your earnings quickly helps with better cash flow.

Choosing the right payment gateway means balancing security, convenience, and compatibility with your Shopify store’s needs.

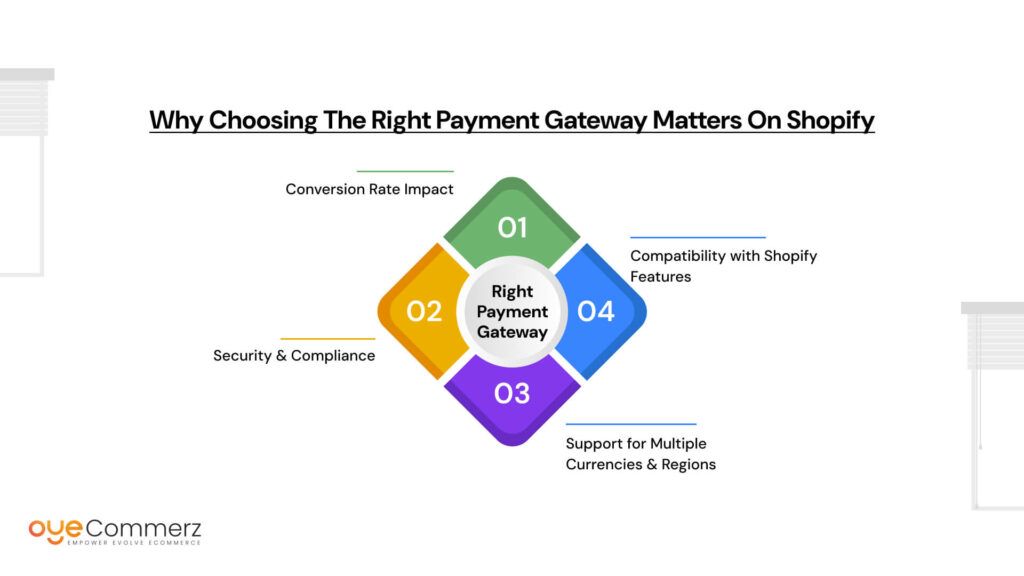

Why Choosing the Right Payment Gateway Matters on Shopify

The payment gateway you choose isn’t just a technical setup, it’s a vital part of your customer’s shopping experience. A smooth, secure, and familiar checkout process can dramatically improve your store’s performance. Here’s why it matters:

Conversion Rate Impact

A complicated or untrustworthy payment process is one of the biggest reasons for cart abandonment. Customers want fast and familiar options whether that’s credit cards, PayPal, or local payment methods. A reliable gateway ensures fewer interruptions, faster checkouts, and higher conversion rates.

Security & Compliance

Online transactions are a major target for fraud, so security is non-negotiable. The right gateway will be PCI DSS compliant, offer SSL encryption, and provide fraud detection tools to protect both your business and your customers. This builds trust and prevents costly chargebacks.

Support for Multiple Currencies & Regions

If you’re targeting international markets, your payment gateway must support global currencies and region-specific methods like UPI in India, SEPA in Europe, or Alipay in China. Without these, you could lose customers simply because they can’t pay in a familiar way.

Compatibility with Shopify Features

Shopify offers powerful tools like Shopify Payments, 1-click checkout, and Shopify POS. The right gateway should integrate smoothly with these features to ensure a consistent and hassle-free customer experience both online and offline.

Best Payment Gateways for Shopify

Choosing the right payment gateway depends on your store’s location, customer preferences, and business model. Below are some of the most popular and reliable gateways that work well with Shopify, along with their pros and cons.

4.1. Shopify Payments

Pros:

- Built directly into Shopify no third-party setup required

- No additional transaction fees (unlike third-party gateways)

- Fully integrated with Shopify’s features, including 1-click checkout and Shopify POS

Cons:

- Only available in select countries (like the US, UK, Canada, Australia, etc.)

- Limited customization for advanced users

Best For: Beginners and stores based in supported countries looking for a simple, all-in-one solution.

4.2. PayPal

Pros:

- One of the most trusted names in online payments

- Widely used by international customers

- Easy to enable in Shopify with minimal configuration

Cons:

- Additional transaction fees

- Redirects customers to PayPal’s site to complete payment, which can disrupt the checkout experience

Best For: Stores with global customers or those wanting to offer a familiar alternative to credit card payments.

4.3. Stripe

Pros:

- Developer-friendly and highly customizable

- Supports a wide range of currencies and countries

- Fast payouts and detailed reporting

Cons:

- Requires third-party integration unless used through Shopify Payments

- More technical setup compared to built-in options

Best For: Tech-savvy store owners or those wanting flexible and global payment processing.

4.4. Authorize.Net

Pros:

- Ideal for established businesses handling large volumes

- Strong fraud prevention tools and recurring billing options

- Supports multiple payment types including eChecks

Cons:

- Complex setup and configuration

- Monthly gateway and transaction fees can be high for small stores

Best For: High-volume or enterprise-level merchants who need robust fraud protection and recurring payment support.

4.5. Razorpay / PayU / CCAvenue

Pros:

- Tailored for the Indian market with UPI, net banking, and mobile wallets

- Support for local currencies and regional compliance

- Integration plugins or APIs available for Shopify

Cons:

- May require manual integration or use of third-party apps

- Limited global support

Best For: Indian Shopify stores targeting domestic buyers with localized payment methods.

4.6. Klarna / Afterpay / Sezzle (Buy Now, Pay Later)

Pros:

- Lets customers pay in installments boosting affordability and AOV (Average Order Value)

- Popular with fashion, beauty, and electronics stores

- Offers risk-free payment to merchants (you get paid upfront)

Cons:

- Not supported in all countries

- May require a Shopify Plus plan or integration via an app

Best For: Stores targeting younger or budget-conscious audiences, especially in fashion or lifestyle niches.

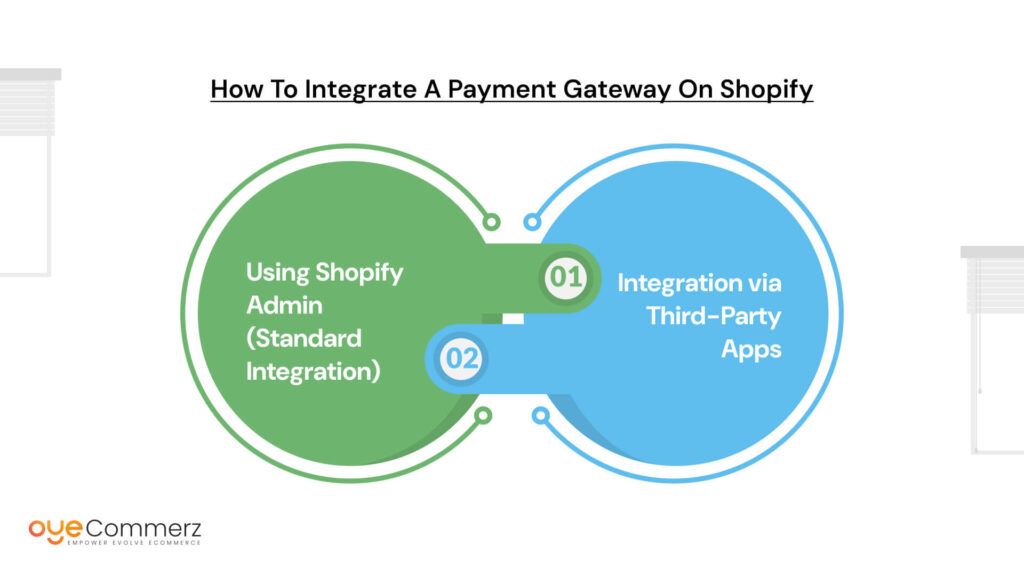

How to Integrate a Payment Gateway on Shopify

Setting up a payment gateway on Shopify is a straightforward process, especially when using built-in or directly supported providers. Whether you’re using Shopify Payments or a third-party gateway, here’s how to get everything running smoothly.

5.1. Using Shopify Admin (Standard Integration)

If you’re choosing a payment provider that’s already supported by Shopify, integration can be done quickly through your admin dashboard:

- Go to your Shopify Admin and click on Settings > Payments.

- Select a provider from the list or enable Shopify Payments if it’s available in your region.

- Enter the required credentials or API keys provided by the gateway (you may need to sign up with the provider separately first).

- Toggle between test mode and live mode to test transactions before going live.

- Click Activate to enable the payment method on your store.

This method works well for providers like PayPal, Stripe (via Shopify Payments), and Authorize.Net.

5.2. Integration via Third-Party Apps

If the payment gateway you want to use isn’t natively supported by Shopify (like Razorpay, PayU, or CCAvenue), you’ll need to integrate it through a third-party app or plugin.

- Search the Shopify App Store for your provider’s official app or a trusted integration tool.

- Some providers offer detailed documentation and plugins that make it easier to connect via custom APIs.

- Example: To integrate Razorpay, you may use a third-party Razorpay app or follow their API documentation to set it up manually through a developer.

This method may require more technical knowledge, but it’s the best way to add local or niche payment methods not available by default.

5.3. Tips for a Smooth Integration

- Always test in sandbox mode before enabling live payments. This helps you catch any issues without risking real transactions.

- Ensure compliance: Your store should have an SSL certificate and clear privacy and refund policies to meet most payment gateway requirements.

- Label payment options clearly based on your audience’s expectations e.g., UPI for Indian users, PayPal for global customers, etc.

By following these steps and best practices, you’ll ensure a secure, reliable, and conversion-friendly payment setup for your Shopify store.

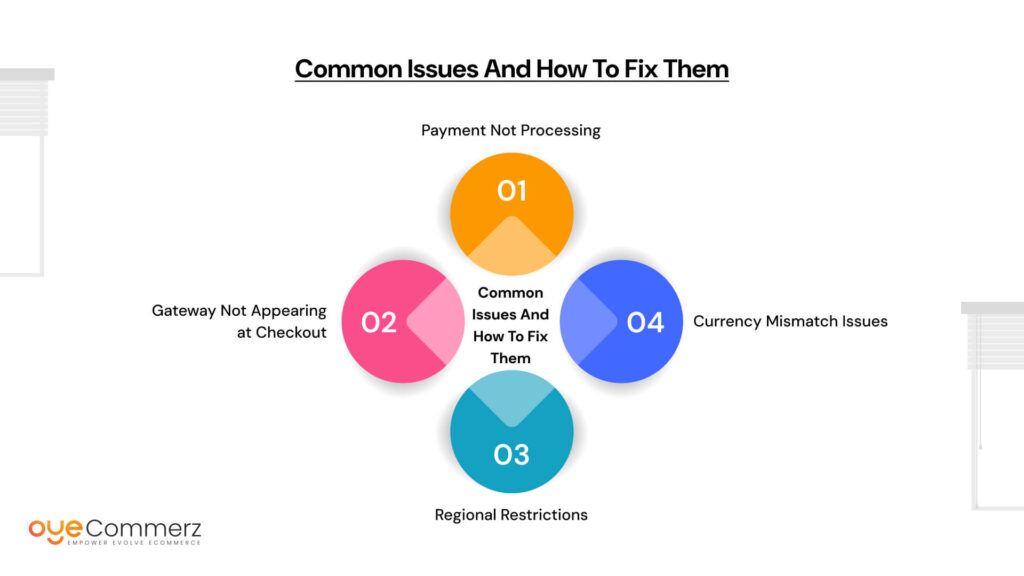

Common Issues and How to Fix Them

While integrating a payment gateway into your Shopify store is typically straightforward, there are a few common issues that can arise during setup or use. Here’s a guide on how to troubleshoot and resolve them:

1. Payment Not Processing

Possible Causes:

- Insufficient funds or card issues with the customer’s bank.

- Gateway configuration errors.

- Fraud protection settings blocking legitimate payments.

How to Fix:

- Check your gateway’s status: Ensure the payment gateway is operational and there are no outages or technical issues on their end.

- Review payment settings: Double-check your API keys and credentials to make sure they are entered correctly in Shopify.

- Check fraud settings: If fraud protection tools are too strict, legitimate payments might be blocked. Adjust your fraud filters if needed.

- Test mode: If you’re in test mode, switch to live mode and confirm that transactions are processed correctly.

2. Gateway Not Appearing at Checkout

Possible Causes:

- The payment gateway isn’t activated correctly.

- Your region or country doesn’t support the selected gateway.

- The payment method is not enabled for certain customer groups or shipping options.

How to Fix:

- Ensure the gateway is active: In your Shopify Admin, go to Settings > Payments and verify that the gateway is marked as “active.”

- Check regional availability: Make sure the payment gateway you’re using is available in your store’s region.

- Confirm eligibility for checkout: Some payment methods only appear for certain shipping options, customer groups, or order values. Ensure your configuration supports all scenarios.

3. Regional Restrictions

Possible Causes:

- The payment gateway might only support transactions from certain countries or regions.

- Some payment gateways are only available in specific Shopify markets or countries.

How to Fix:

- Check supported regions: Review the gateway’s terms and conditions to confirm whether it supports your country or your customer’s location.

- Consider an alternative gateway: If regional restrictions are preventing you from offering certain payment options, look for a different gateway that supports your target market (e.g., local payment methods like Razorpay for India or Alipay for China).

4. Currency Mismatch Issues

Possible Causes:

- The payment gateway is set up to process a different currency than your store’s default currency.

- Currency conversion fees can apply when a customer pays in a different currency.

How to Fix:

- Match currencies: In Settings > Payments, make sure that the payment gateway is set to accept payments in your store’s default currency or an appropriate supported currency.

- Enable multi-currency support: Shopify Payments, for example, allows you to sell in multiple currencies. Make sure your gateway is set to handle the correct currencies for your target market.

- Clarify fees: Ensure customers are aware of any potential currency conversion fees, especially if using international payment methods.

By resolving these common issues, you can ensure a smoother experience for both you and your customers, leading to better sales and fewer transaction problems.

Need Help Setting Up Your Payment Gateway the Right Way?

Setting up the perfect payment gateway for your Shopify store can be tricky especially if you’re facing technical issues or unsure which gateway best fits your business needs. At Oyecommerz, we specialize in Shopify payment gateway integration and can ensure a smooth setup process that works seamlessly with your store’s operations.

Why Choose Oyecommerz?

- Expert Setup: Our team of Shopify experts will guide you through the setup of your payment gateway, ensuring that it’s fully optimized and functional.

- Error Fixes: Encountering payment errors? We’ll fix any issues quickly to keep your sales flowing without interruptions.

- Ongoing Optimization: We don’t just stop at setup we’ll help you fine-tune your payment options for better customer satisfaction and higher conversion rates.

Get in Touch Today!

Let us handle the technical side while you focus on growing your business. Contact Oyecommerz for a hassle-free, professional payment gateway setup and optimization today!

Let's build your custom Shopify app today!

Conclusion

Selecting the right payment gateway for your Shopify store is essential for boosting conversions, ensuring security, and offering a seamless checkout experience for your customers. When making your choice, consider factors like location, customer preferences, and transaction fees. For ease of use, Shopify Payments is a great option to start with, as it integrates directly with your store and eliminates additional fees. However, if you’re unsure about the setup or have specific needs, consulting an expert in Shopify payment gateway integration can help ensure you’re making the best decision for your business.

Frequently Asked Questions

To integrate a payment gateway in Shopify:

Go to Shopify Admin > Settings > Payments

Choose a payment provider from the list or activate Shopify Payments (if available in your country)

Enter the required API keys or credentials from your provider

Use test mode to check setup, then switch to live mode to start accepting real payments

For unsupported gateways, you can integrate using third-party apps or custom APIs.

Yes, Shopify offers its own built-in payment gateway called Shopify Payments. It supports major credit/debit cards, Apple Pay, Google Pay, and more, without third-party transaction fees. It’s easy to set up and is fully integrated into your Shopify store.

The best payment provider depends on your location and customer base:

Shopify Payments – Best for ease of use and no extra transaction fees

PayPal – Great for international customers and trust factor

Stripe – Ideal for global reach and developer-friendly features

Razorpay/PayU – Best for India-specific payments like UPI and net banking

Klarna/Afterpay – Great for Buy Now, Pay Later options

To use a payment gateway on Shopify, you’ll need:

A Shopify store with a valid plan

Business details (name, address, phone number, etc.)

A bank account to receive payouts

Legal compliance: SSL certificate, refund policy, and privacy policy

API credentials if using a third-party gateway

With Shopify Payments, you avoid extra transaction fees from third-party providers. However, Shopify still charges a standard credit card processing fee based on your plan and country. For example:

2.9% + 30¢ per transaction on the Basic Shopify plan (in the U.S.) If you use a third-party gateway, Shopify also charges an additional 2% transaction fee unless you’re using Shopify Plus or Shopify Payments.