For e-commerce businesses, even a small financial discrepancy can mean misreported sales, tax compliance issues, and cash flow nightmares.Did you know that 88% of spreadsheets contain errors, leading to costly accounting mistakes? .

When Shopify and QuickBooks don’t sync properly, you might face duplicate transactions, missing refunds, incorrect inventory records, or tax miscalculations. These issues don’t just create a bookkeeping mess—they can also lead to IRS penalties and financial losses.

If you’re struggling with integration errors, don’t worry—you’re not alone. In this guide, we’ll walk you through the most common Shopify-QuickBooks syncing issues, why they happen, and most importantly, how to Fix Shopify and QuickBooks Integration for a seamless accounting experience. Let’s get started!

Table of Contents

ToggleUnderstanding Shopify-QuickBooks Integration Basics

Before diving into solutions, it’s important to understand how Shopify and QuickBooks work together. A smooth integration ensures accurate financial records, tax compliance, and streamlined reporting. But when errors occur, they can throw off your entire accounting system. Let’s break down the essentials.

How Shopify and QuickBooks Work Together

Shopify is your sales platform, while QuickBooks manages your finances. The integration between them helps you:

- Automatically sync sales, refunds, and fees

- Track inventory and cost of goods sold (COGS)

- Manage taxes and reconcile payments

When done right, this automation saves time and reduces human errors. However, if you don’t Fix Shopify and QuickBooks Integration properly, discrepancies can lead to misreported revenue, tax miscalculations, and inventory mismatches.

Types of Shopify-QuickBooks Integrations

There are two primary ways to connect Shopify and QuickBooks:

- Native Integration – Shopify’s built-in QuickBooks app syncs basic sales and tax data but may lack customization.

- Third-Party Connectors – Apps like A2X, Synder, and Webgility offer advanced features, such as multi-channel syncing and automated error detection.

Choosing the right integration method is key to preventing accounting headaches. If your current setup isn’t working, don’t worry—we’ll show you how to fix it in the next section!

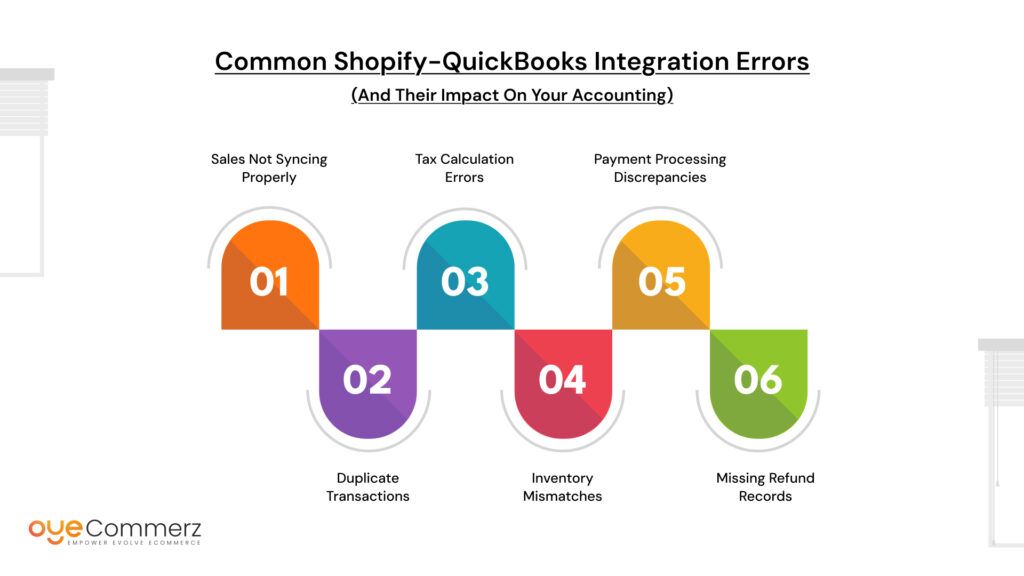

Common Shopify-QuickBooks Integration Errors (And Their Impact on Your Accounting)

When Shopify and QuickBooks don’t sync properly, accounting errors can pile up fast. These mistakes can distort financial reports, create tax compliance risks, and cause inventory mismanagement. If you don’t Fix Shopify and QuickBooks Integration issues early, they can lead to costly financial discrepancies.

Here are the most common errors businesses face:

1. Sales Not Syncing Properly

- Some transactions don’t transfer from Shopify to QuickBooks, leading to incomplete revenue reporting.

- Misaligned sales data makes it hard to track profitability and taxes.

2. Duplicate Transactions

- The same order appears twice, inflating revenue figures and leading to incorrect financial reports.

- This can happen due to manual imports, multiple integrations, or API sync errors.

3. Tax Calculation Errors

- Sales tax settings in Shopify may not match those in QuickBooks, leading to overpayment or underpayment of taxes.

- Incorrect tax reporting can cause compliance issues with state and federal tax authorities.

4. Inventory Mismatches

- Shopify records a sale, but QuickBooks doesn’t update inventory levels correctly, causing overstocking or stockouts.

- This disrupts demand planning and affects cash flow.

5. Payment Processing Discrepancies

- Shopify payments, PayPal, or Stripe transactions don’t align with QuickBooks bank feeds.

- Unmatched payments make reconciliation difficult, leading to misreported revenue and expenses.

6. Missing Refund Records

- Refunds processed in Shopify don’t reflect in QuickBooks, skewing financial statements.

- This leads to inaccurate cash flow tracking and potential customer disputes.

Each of these errors can create serious financial confusion. In the next section, we’ll break down the root causes and how to fix them effectively.

Why These Integration Issues Happen (Root Causes)

Understanding why errors occur is the first step to properly Fix Shopify and QuickBooks Integration problems. These issues usually stem from misconfigurations, software limitations, or data transfer inconsistencies. Here are the most common causes:

1. API Limitations and Data Transfer Lags

- Shopify and QuickBooks communicate through an API, but delays in data syncing can cause missing or duplicated transactions.

- Large volumes of data may lead to incomplete transfers, affecting financial accuracy.

2. Incorrect Shopify or QuickBooks Settings

- Misconfigured tax rules, currency settings, or account mappings can lead to inaccurate reports.

- Default settings may not align with your business’s accounting needs, requiring manual adjustments.

3. Misconfigured Tax Settings

- Shopify collects sales tax based on location, but if QuickBooks isn’t set up correctly, tax calculations may not match.

- This leads to incorrect tax filings and potential compliance issues with the IRS or state tax authorities.

4. Third-Party App Conflicts

- Using multiple integrations (e.g., third-party accounting apps, inventory tools, or payment gateways) can cause data duplication or sync failures.

- Some apps override Shopify’s default settings, creating inconsistencies in financial reports.

5. Manual Entry Errors

- Entering data manually to correct integration issues can lead to duplicate transactions, incorrect amounts, or misclassified expenses.

- Relying on manual adjustments increases the risk of human error and accounting discrepancies.

6. Outdated Software Versions

- Running outdated versions of Shopify, QuickBooks, or third-party connectors can cause compatibility issues.

- Regular updates are required to maintain a stable and error-free integration.

Identifying the root cause of integration errors helps in applying the right fix. In the next section, we’ll go step by step on how to resolve these issues efficiently.

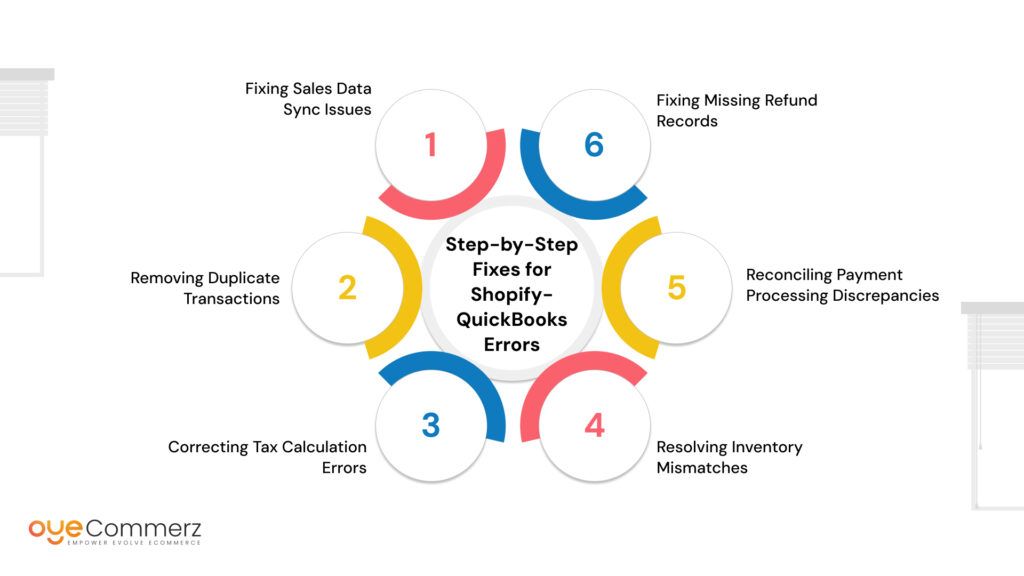

Step-by-Step Fixes for Shopify-QuickBooks Errors

Now that the common errors and their causes are clear, it’s time to Fix Shopify and QuickBooks Integration issues effectively. Below are step-by-step solutions for each problem to ensure accurate financial reporting and seamless syncing.

1. Fixing Sales Data Sync Issues

- Go to QuickBooks App Settings and ensure that Shopify is properly connected.

- Check if all transactions are assigned to the correct accounts in QuickBooks.

- Manually trigger a sync and compare recent orders in both Shopify and QuickBooks.

- If transactions are still missing, use a third-party sync tool like A2X or Synder.

2. Removing Duplicate Transactions

- Review your QuickBooks Sales and Income Accounts for repeated entries.

- If duplicates exist, check whether transactions were manually imported in addition to automatic sync.

- Delete the duplicate records and adjust mapping settings to prevent future duplication.

3. Correcting Tax Calculation Errors

- Compare tax rates in Shopify’s Tax Settings and QuickBooks’ Tax Center to ensure they match.

- If discrepancies exist, update tax rules in QuickBooks to align with Shopify’s settings.

- Run a tax report to verify that all Shopify sales are categorized correctly in QuickBooks.

4. Resolving Inventory Mismatches

- Check if inventory tracking is enabled in both Shopify and QuickBooks.

- Ensure that each product has the same SKU in both platforms to avoid incorrect stock adjustments.

- Run an inventory audit in QuickBooks and update stock levels if necessary.

5. Reconciling Payment Processing Discrepancies

- Open QuickBooks’ Banking Section and match Shopify payments with the corresponding deposits.

- If transactions are missing, check Shopify’s Payout Reports and manually add any missing data.

- If mismatches persist, reauthorize the Shopify-QuickBooks connection and reattempt sync.

6. Fixing Missing Refund Records

- Review Shopify’s Orders and Refunds Report and compare it with QuickBooks’ refund entries.

- If a refund is missing, manually add it in QuickBooks under the correct customer account.

- Adjust sync settings to ensure refunds are automatically transferred moving forward.

Fixing these integration issues requires regular monitoring and adjustments. If these steps don’t resolve your problems, consider upgrading to a more advanced integration solution or seeking expert assistance.

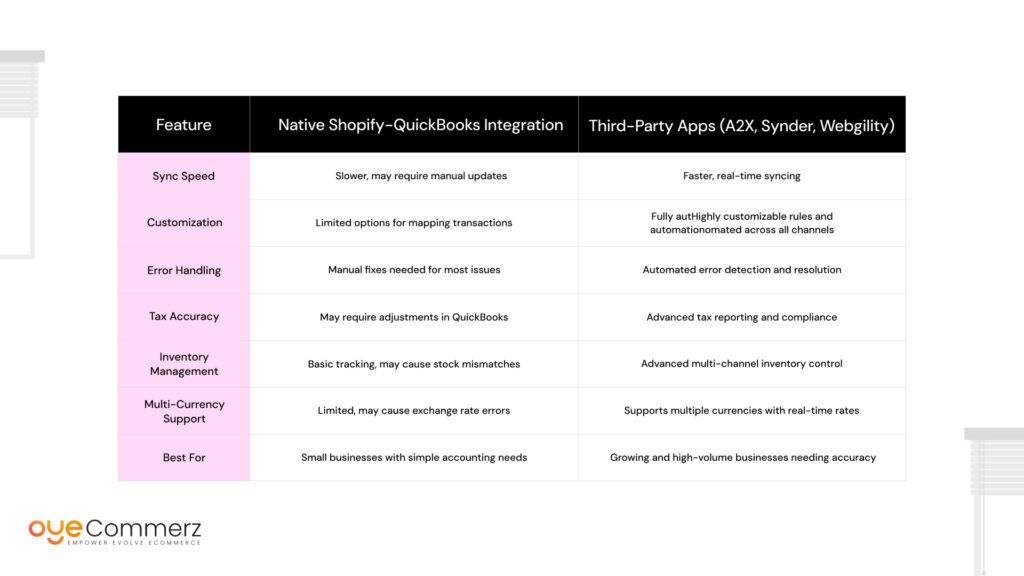

Comparison Table: Native Shopify-QuickBooks Integration vs. Third-Party Apps

When looking to Fix Shopify and QuickBooks Integration, choosing the right syncing method is crucial. Shopify offers a built-in QuickBooks integration, but it has limitations. Many businesses turn to third-party apps for better accuracy and automation. Below is a comparison to help you decide which option is best for your business.

Which Option is Right for You?

- If you run a small Shopify store with basic accounting needs, the native integration might be sufficient.

- If you have complex sales, multi-channel orders, or tax concerns, a third-party app can provide better accuracy and automation.

If you are struggling with ongoing errors, upgrading your integration method might be necessary. In the next section, we’ll discuss how migrating to Shopify with professional support can ensure a seamless accounting experience.

Contact to Migrate your Site to Shopify Now

If Fixing Isn’t Enough: Why You Should Consider Migrating to Shopify with Oyecommerz

Sometimes, no matter how much troubleshooting is done, persistent errors continue to disrupt financial accuracy. If your current system is outdated, incompatible, or simply not working as expected, a full migration might be the best solution.

Oyecommerz specializes in Shopify migrations with a focus on seamless QuickBooks integration, ensuring businesses don’t have to deal with ongoing syncing issues.

Why Migration Might Be the Best Fix

- Outdated Systems: If your current platform or third-party integrations are no longer supported, fixing issues becomes a constant challenge.

- Recurring Sync Errors: If transactions, taxes, or inventory are frequently misaligned despite corrections, the integration setup may be fundamentally flawed.

- Scaling Challenges: As your business grows, your accounting needs become more complex. A properly structured Shopify and QuickBooks setup prevents bottlenecks.

- Time and Cost Savings: Spending hours fixing manual errors costs more in the long run than investing in a professionally managed migration.

How Oyecommerz Ensures a Smooth Transition

- Expert-Led Shopify Migration: Migrate from any platform to Shopify while ensuring financial records remain intact.

- Flawless QuickBooks Setup: Configure the right QuickBooks version, tax settings, and payment mappings to avoid future errors.

- Automated Accounting Workflows: Implement advanced integration tools that sync transactions, inventory, and reports with minimal manual effort.

If fixing ongoing integration problems has become a burden, a structured migration with Oyecommerz can provide a long-term solution.

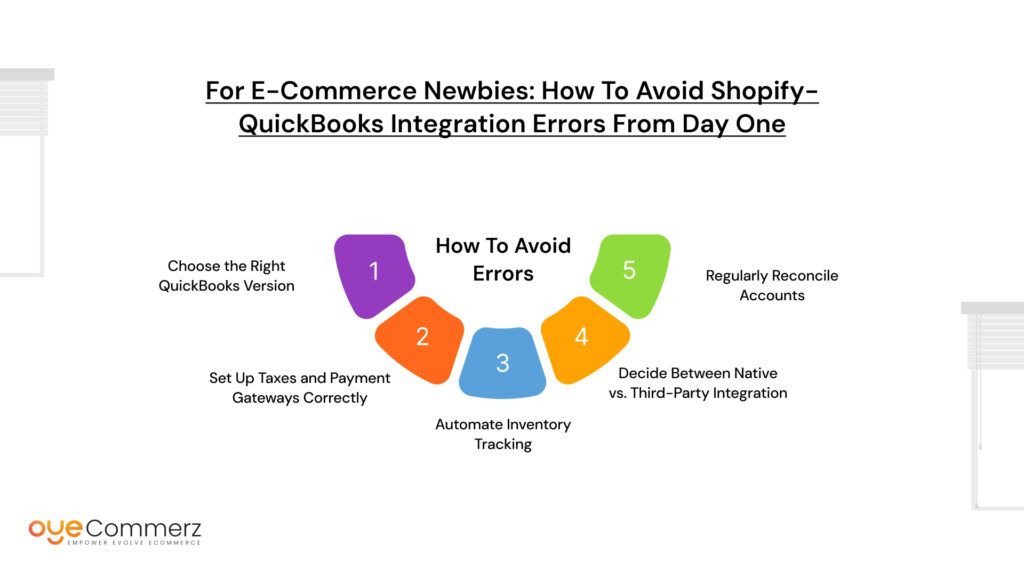

For E-Commerce Newbies: How to Avoid Shopify-QuickBooks Integration Errors from Day One

If you’re new to e-commerce, setting up Shopify and QuickBooks correctly from the beginning can prevent costly errors down the road. Many integration problems happen due to misconfigurations, incorrect tax settings, or choosing the wrong syncing method. Follow these best practices to Fix Shopify and QuickBooks Integration before issues arise.

1. Choose the Right QuickBooks Version

- QuickBooks Online: Best for businesses that need cloud access and automatic updates.

- QuickBooks Desktop: Suitable for businesses with complex accounting needs but requires manual updates.

- Ensure you choose the version that integrates best with Shopify to avoid compatibility issues.

2. Set Up Taxes and Payment Gateways Correctly

- Enable Shopify’s automated tax collection and match the settings with QuickBooks.

- If selling in multiple states, use a tax automation tool like Avalara or TaxJar to prevent errors.

- Match payment gateway fees (Shopify Payments, PayPal, Stripe) to avoid discrepancies in financial reports.

3. Automate Inventory Tracking

- Enable inventory sync between Shopify and QuickBooks to prevent stock mismatches.

- Use consistent SKUs across both platforms to ensure products are correctly matched in reports.

- If selling on multiple channels (Amazon, eBay, Walmart), use a multi-channel inventory tool like A2X or Webgility.

4. Decide Between Native vs. Third-Party Integration

- Shopify’s built-in QuickBooks app works for small stores but has limited functionality.

- For growing businesses, a third-party app like Synder, A2X, or Webgility offers better automation and accuracy.

- Choosing the right integration method from the start prevents the need for future fixes.

5. Regularly Reconcile Accounts

- Set a schedule to review and reconcile transactions in QuickBooks at least once a week.

- Run reports to check for duplicate transactions, missing refunds, and tax mismatches before errors accumulate.

- Ensure Shopify payouts match QuickBooks deposits to prevent cash flow discrepancies.

By following these best practices, new e-commerce businesses can avoid common pitfalls and maintain accurate financial records. If integration issues still arise, professional assistance may be needed to ensure a seamless accounting setup.

Conclusion

Accounting errors caused by syncing issues can lead to misreported revenue, tax compliance risks, and inventory mismatches. Whether you’re dealing with duplicate transactions, missing refunds, or incorrect tax calculations, the key to solving these problems is understanding their root cause and applying the right fixes.

To Fix Shopify and QuickBooks Integration effectively:

- Choose the right integration method based on your business needs.

- Ensure taxes, inventory, and payment gateways are correctly configured.

- Use automation tools to minimize manual errors.

- Regularly reconcile transactions to prevent discrepancies.

If recurring integration issues are slowing down your business, it might be time for a more reliable solution. Oyecommerz can help you migrate to Shopify with a fully optimized QuickBooks setup, ensuring seamless accounting from day one.

Fix the errors today, streamline your financial operations, and focus on growing your business without accounting headaches.