Are you currently running your business on Wix but feeling like something’s eating away at your profits? If you’ve noticed your revenue shrinking despite steady sales, hidden Wix transaction fees might be the culprit. These silent costs can add up quickly, cutting into your bottom line and making it harder to grow your business.

For many existing Wix business owners, the solution might be simpler than you think: migrating to Shopify. With Shopify’s transparent pricing, advanced tools, and scalability, you can stop losing money to hidden fees and start focusing on what matters which is your business growth.

In this blog, we’ll explore how hidden Wix transaction fees can affect your profits, compare Wix with Shopify, and show why making the switch could be the best decision for your e-commerce success. Ready to take back control of your earnings? Let’s dive in!

Table of Contents

ToggleWhat Are Hidden Wix Transaction Fees and How Do They Work?

If you’re using Wix for your online store, you might think you’re paying only the subscription fee—but there’s more to it than meets the eye. Hidden Wix transaction fees are additional costs that creep into your billing cycle, often unnoticed. These fees can significantly impact your profits if not properly managed. Let’s break down what they are and how they work.

Understanding Wix’s Fee Structure

At first glance, Wix advertises a flat-rate subscription fee for its e-commerce plans. However, beyond this fee, there are transaction-related costs that many users are unaware of. Here’s a typical breakdown:

How These Fees Work in the Background

When a customer makes a purchase, the gross revenue enters your account. However, payment processing fees are deducted before you see the funds. For businesses with international sales, additional conversion fees further shrink the revenue. Over time, these hidden charges add up, leaving less room for reinvestment.

Implications for Your E-Commerce Profits

These fees might seem small individually, but their cumulative impact is significant. For instance:

- A business generating $10,000 in monthly sales could lose over $300 to $500 solely to transaction fees.

- Over a year, that’s up to $6,000, money that could have been reinvested in marketing, inventory, or customer acquisition.

Transparency Issues

One of the challenges Wix users face is the lack of upfront clarity about these fees. Unlike some platforms that provide detailed breakdowns, Wix’s fee structure often requires extra digging to understand fully. This lack of transparency makes it difficult for business owners to predict their true expenses.

The True Cost of Hidden Wix Transaction Fees on Your Business

While a small fee here and there might not seem like a big deal, hidden Wix transaction fees can silently erode your profits, for Wix users, understanding the full scope of these fees is critical for managing costs and optimizing earnings. Let’s uncover the true cost of these fees and their impact on your business.

How Hidden Wix Fees Impact Profit Margins

Every sale you make on your Wix store is subject to transaction fees that reduce your actual revenue. Here’s how it works:

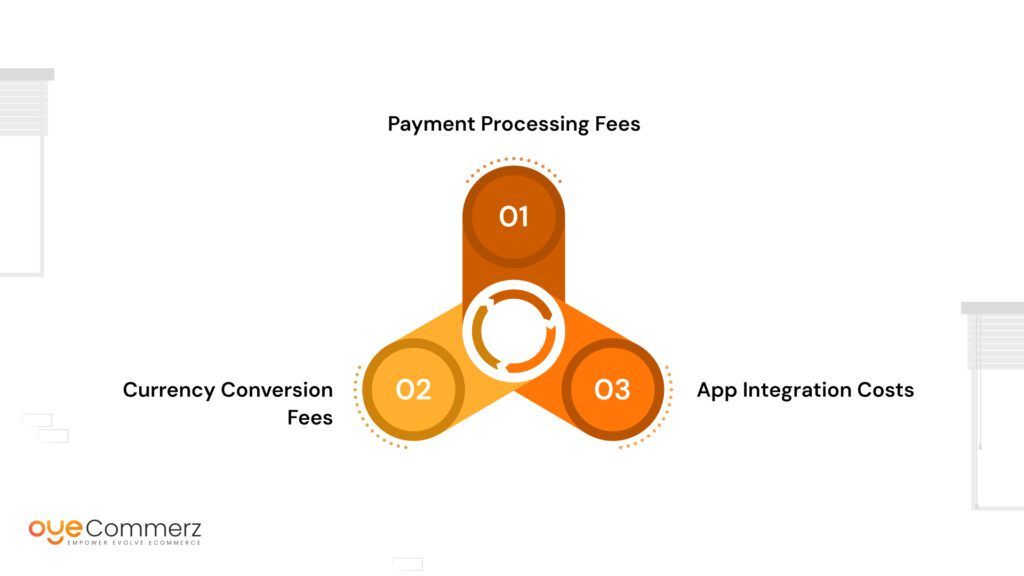

- Payment Processing Fees

These are deducted automatically during the payment process. For example:- For a $100 sale, with a 2.9% + $0.30 fee, you’ll pay $3.20 in fees.

- If you process 1,000 sales monthly, you’re looking at $3,200 in fees every month—or nearly $38,400 per year.

- Currency Conversion Fees

For businesses selling internationally, these fees add up quickly:- A 3% conversion fee on $10,000 in monthly sales equals $300 lost per month.

- Over a year, that’s $3,600 gone to conversion costs.

- App Integration Costs

Many Wix users rely on third-party apps for additional functionality. While these apps enhance your store, their subscription or per-use fees further chip away at profits.

Hidden Costs You May Not Expect

Apart from the obvious fees, there are other costs Wix users might not anticipate:

- Chargeback Fees: These can range from $10 to $25 per dispute and can be a significant burden for stores with high transaction volumes.

- Delayed Payouts: Depending on your payment gateway, funds might take days to reach your account, impacting your cash flow.

The Ripple Effect on Business Growth

When profits are reduced by hidden fees, your ability to reinvest in your business diminishes. You may face:

- Limited Marketing Budgets: Less revenue to allocate toward ads and customer acquisition.

- Inventory Challenges: Difficulty in stocking up on high-demand products.

- Scaling Hurdles: Struggling to expand your business due to tight margins.

Breaking Down Wix Fees: Subscription Costs vs. Transaction Fees

To truly understand the financial impact of hidden Wix transaction fees, it’s essential to separate Wix’s subscription costs from its transaction-related charges. While the subscription fee is upfront and seemingly affordable, the additional fees layered on top can significantly inflate your expenses. Wix’s Business Basic plan starts at $27 per month, but this doesn’t include transaction fees, which can add up significantly over time.

Wix Subscription Plans: What You’re Paying For

Wix offers tiered subscription plans for e-commerce businesses. These plans include features such as website hosting, templates, and basic analytics. Here’s an overview:

While these plans might seem cost-effective, they don’t include transaction-related costs, which vary depending on your payment gateway and sales volume.

Transaction Fees: The Hidden Costs

Transaction fees are where Wix costs can balloon, especially for high-volume stores. These include:

- Payment Processing Fees

- Wix Payments: Charges 2.9% + $0.30 per transaction for domestic payments.

- Third-Party Gateways: Providers like PayPal or Stripe may have similar or higher fees.

- Currency Conversion Fees

- For international sales, conversion fees of 2-3% are applied when the customer’s currency differs from yours.

- These are typically deducted before you receive the funds.

- Additional Service Fees

- Certain add-ons or premium features required for scaling your store might carry monthly or usage-based costs.

- Certain add-ons or premium features required for scaling your store might carry monthly or usage-based costs.

Identifying and Tracking Additional Expenses

To keep track of your expenses on Wix, you’ll need to:

- Monitor Gateway Statements: Regularly check for payment processing and conversion fees.

- Analyze Monthly Reports: Consolidate app subscription fees, chargebacks, and transaction costs.

- Use Accounting Tools: Consider integrating financial tracking software to get a clear picture of your actual expenses.

By breaking down the subscription and transaction fees, it becomes evident that hidden Wix transaction fees can quickly outweigh the benefits of its seemingly affordable plans.

Are Hidden Wix Transaction Fees Eating Into Your Profits?

When running an e-commerce business, profitability is king. For many Wix users, the seemingly affordable subscription plans may disguise a deeper issue: the compounding impact of hidden Wix transaction fees on your revenue. Let’s examine how these fees quietly chip away at your bottom line.

The Profit-Drain Cycle of Hidden Fees

Hidden fees on Wix often feel inconsequential at first glance, but over time, they accumulate and erode your profits. Here’s a simple calculation to demonstrate this impact:

- Monthly Revenue: $10,000

- Payment Processing Fees (2.9% + $0.30): $3.20 per transaction x 500 transactions = $1,600/month.

- Currency Conversion Fees (2.5% for 40% of sales): $4,000 x 2.5% = $100/month.

- Additional Costs (apps, chargebacks, etc.): $200/month.

Total Monthly Fees: $1,900

Annual Loss: $22,800

For small to medium businesses, this can be a significant dent in profitability, limiting opportunities to reinvest in marketing, inventory, or customer acquisition.

The Psychological Impact of “Hidden” Fees

Hidden costs are not just a financial issue—they also impact business decisions:

- Reduced Confidence in Pricing: If fees aren’t transparent, you may underprice products to stay competitive, further hurting profits.

- Difficulty Scaling: Unpredictable costs make it harder to plan for growth or expansion.

- Erosion of Trust: Many Wix users feel misled when they discover fees they weren’t prepared for, leading to dissatisfaction with the platform.

Comparison With Transparent Platforms

One reason many businesses switch to platforms like Shopify is their commitment to fee transparency. While Shopify also charges transaction and processing fees, they provide detailed breakdowns, so you always know where your money is going. This level of transparency helps business owners:

- Forecast Expenses Accurately

- Identify Cost-Saving Opportunities

- Plan for Long-Term Growth

Strategies for Evaluating the Impact on Your Profits

To determine if hidden Wix transaction fees are eating into your profits:

- Analyze Your Financial Reports: Check how much of your revenue is being consumed by transaction and app fees.

- Calculate Effective Net Profit: Subtract all hidden costs from your gross revenue to understand the true profitability.

- Compare With Alternatives: Research platforms like Shopify to see if switching could reduce your costs.

Signs It’s Time to Migrate

- You notice a consistent drop in profit margins despite steady or increasing sales.

- Your international sales are suffering due to high conversion fees.

- Managing costs feels overwhelming due to the lack of clarity in Wix’s fee structure.

Proven Strategies to Minimize Hidden Wix Transaction Fees

If you’re committed to using Wix for your e-commerce business, it’s essential to find ways to reduce the impact of hidden Wix transaction fees. While these fees can’t always be eliminated, strategic adjustments can help minimize their effect on your profits.

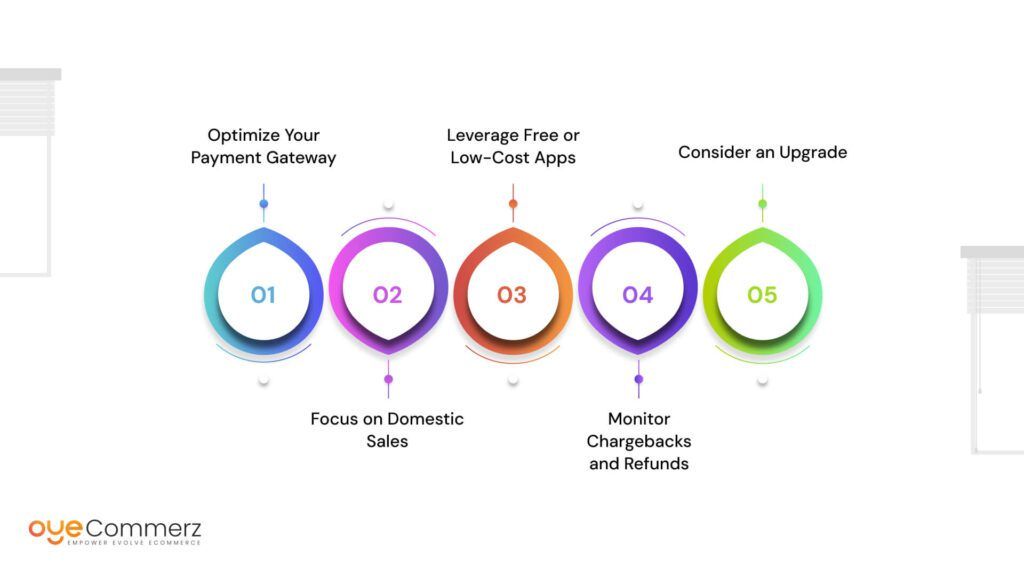

Optimize Your Payment Gateway

Wix primarily uses its own payment system, but you can explore third-party options that offer lower transaction fees. Compare rates between:

- Wix Payments: Standard 2.9% + $0.30 per transaction.

- PayPal or Stripe: Often similar but may include additional benefits like better currency conversion rates or faster payouts.

Focus on Domestic Sales

Currency conversion fees can quickly add up for businesses with international customers. If possible:

- Prioritize domestic sales where conversion isn’t necessary.

- Set up local bank accounts or regional payment gateways to avoid extra fees.

Leverage Free or Low-Cost Apps

Many Wix users rely on third-party apps for additional functionality, but these can be expensive.

- Audit your current app subscriptions and remove unnecessary tools.

- Opt for free alternatives or Wix’s native features wherever possible.

Monitor Chargebacks and Refunds

Chargebacks come with hefty fees, so minimize them by:

- Clearly communicating your return policy.

- Providing excellent customer service to avoid disputes.

Consider an Upgrade

If your sales volume is high, consider upgrading to a higher-tier plan that might offer better value. While the subscription fee is higher, it could include features that reduce reliance on paid apps.

Should You Stick With Wix or Explore Other Platforms?

After evaluating the impact of hidden Wix transaction fees, many business owners wonder if sticking with Wix is the right choice. The answer depends on your business needs, growth aspirations, and budget.

When Wix May Still Be Suitable

Wix is a good fit for:

- Small Businesses: If you have low sales volume and need an easy-to-use platform.

- DIY Entrepreneurs: Those who prefer simple, drag-and-drop website builders without extensive customization needs.

- Local Stores: Businesses catering primarily to domestic customers to avoid conversion fees.

When to Consider Shopify

Shopify might be a better option if:

- You’re Scaling Rapidly: Its tools and integrations are better suited for large-scale operations.

- You Need Transparency: Shopify’s fee breakdowns allow for better financial planning.

- You Want Advanced Features: Built-in analytics, marketing tools, and global payment flexibility are key strengths.

Cost Implications of Switching

While switching platforms involves upfront costs for migration and setup, these expenses are often offset by long-term savings on hidden fees. For example:

- Lower currency conversion fees with Shopify can save businesses selling internationally thousands of dollars annually.

- Built-in features like Shopify Pay reduce reliance on paid apps, lowering overall expenses.

- Shopify integrates with over 100 different global payment gateways, providing more options compared to Wix’s 61 payment gateways.

Making the Decision

To decide whether to stick with Wix or migrate to Shopify, ask yourself:

- Are hidden Wix transaction fees significantly impacting my profits?

- Do I need more advanced tools to scale my business?

- Is fee transparency important for my financial planning?

Migrate to Shopify with OyeCommerz

Ready to leave behind the frustration of hidden Wix transaction fees and embrace a more profitable future? At OyeCommerz, we specialize in seamless platform migrations tailored to your business needs. From data transfer to design optimization, our team ensures a smooth transition to Shopify so you can focus on growth.

Take the first step toward better profitability and scalability today. Reach out to us and let’s get started on your Shopify journey! Your success is our mission.

Contact to Migrate your Site to Shopify Now

Conclusion

Hidden fees can make or break your e-commerce success. While Wix is a great starting point, its hidden Wix transaction fees can hinder profitability as your business grows. Shopify stands out as a transparent, scalable alternative that helps you save on costs while offering advanced tools to boost your store’s performance. Switching may feel like a big step, but the long-term benefits far outweigh the initial effort. By transitioning to Shopify, you’re investing in better profit margins, enhanced features, and a more predictable financial future.

Don’t let hidden fees drain your profits—take control of your e-commerce business today.