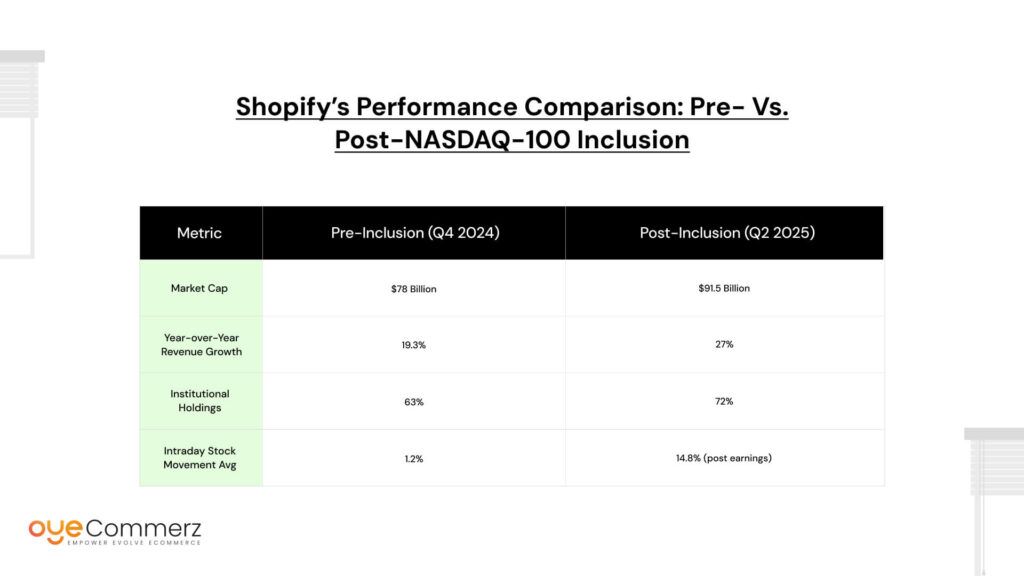

What happens when a digital commerce disruptor posts breakout earnings and earns a seat at the tech elite’s table? Shopify’s latest earnings report revealed a 27% year-over-year revenue jump, driving a 14.8% intraday stock surge, with stable EBITDA and minimal tariff impact, a promising sign as the company doubles down on AI to fuel future growth.

The company’s inclusion in Shopify NASDAQ-100 is more than just a financial milestone, it signals a new era in platform-driven scalability. As Shopify shifts from the NYSE to NASDAQ, it reflects a larger shift in e-commerce investment behavior: a transition from betting on pure-play retailers to backing infrastructure-first ecosystems.

In this blog, we decode how this inclusion signals deeper, long-term trends in digital commerce and explore how your business can stay ahead by leveraging powerful, end-to-end Shopify services.

Table of Contents

ToggleUnderstanding Shopify NASDAQ-100 Inclusion

The NASDAQ-100 is one of the most influential stock indices in the global tech sector. It includes the top 100 largest non-financial companies listed on the NASDAQ stock exchange, representing the backbone of digital innovation, think Apple, Amazon, Microsoft, and now Shopify.

Why NASDAQ-100 Matters:

- Market Weight: It accounts for over 90% of the NASDAQ Composite’s market value, influencing ETFs, mutual funds, and algorithmic trading strategies.

- Investor Visibility: Inclusion attracts institutional investors, creating long-term liquidity and trust.

- Credibility Boost: Brands listed gain elevated status, often signaling operational maturity and strong fundamentals.

NASDAQ-100 Eligibility Criteria:

To be included, a company must:

- Be listed exclusively on NASDAQ.

- Rank among the top 100 by market capitalization (excluding financial institutions).

- Maintain consistent trading volume and public float requirements.

- Meet minimum listing period and governance standards.

Why Shopify Qualified:

Shopify met all criteria after its strategic shift from NYSE to NASDAQ in early 2025, improving its tech alignment. With strong fundamentals, rising profitability, and market cap growth, Shopify gained eligibility and replaced Walgreens Boots Alliance in the index.

Shopify outlines strong Q1 2025 results with 27% revenue growth and 31% international GMV increase

Strategic Timing in Q2 2025:

- The move followed consistent outperformance across 2024.

- Surge in institutional confidence after Shopify introduced scalable AI features.

- Positive earnings, stable EBITDA, and minimal geopolitical tariff impact.

A Seat at the Tech Giants’ Table:

Being added alongside companies like Apple, Amazon, and Meta is a defining leap. It reshapes how Shopify is viewed, not just as a retail enabler but a tech ecosystem leader.

Shopify’s Performance Comparison: Pre- vs. Post-NASDAQ-100 Inclusion

This strategic repositioning represents more than optics, it’s a clear shift in e-commerce investment focus from retail transactions to full-stack technology providers like Shopify.

From Platform to Powerhouse: Shopify’s Strategic Evolution

In 2015, Shopify was known primarily as a SaaS ecommerce platform helping small businesses launch online stores. A decade later, it has evolved into a global retail enabler, and now, a NASDAQ-100-worthy force shaping the next generation of digital commerce.

Key Milestones Defining Shopify’s Rise:

- Q1 2025 Revenue: Shopify posted $1.76 billion in Q1 revenue, up 24% YoY, reflecting merchant expansion and deeper product adoption.

- Merchant Base: Over 2.7 million active merchants across 175 countries now rely on Shopify.

- AI Commerce Suite: Launched early 2025, integrating dynamic pricing, inventory forecasting, and real-time customer insights.

- Shopify Fulfillment Network (SFN): Expanded warehouse and delivery infrastructure, allowing 2-day shipping for 90% of U.S. customers.

- Fintech Strength: Shopify Payments, Shop Pay Installments, and Shopify Capital processed over $40 billion in GMV in the first half of 2025.

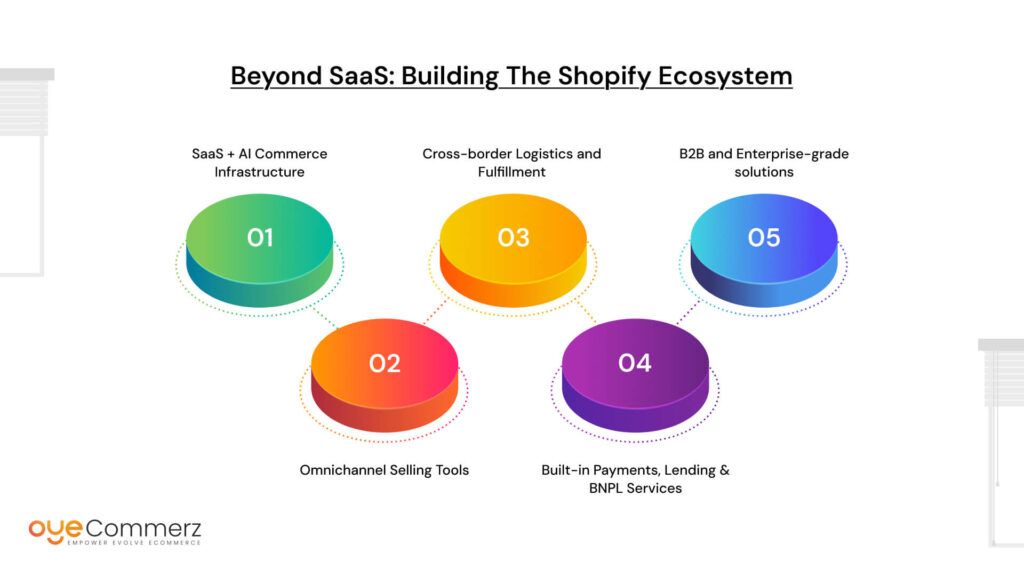

Beyond SaaS: Building the Shopify Ecosystem

What truly makes Shopify a NASDAQ-100 inclusion story isn’t just earnings, it’s the end-to-end ecosystem. It now delivers:

This vertical integration has positioned Shopify as more than software, it’s a retail operating system.

Why Shopify Was Technically & Financially NASDAQ-100-Worthy

- Market Cap Stability: Consistently stayed above $85 billion in Q1/Q2 2025.

- Consistent Revenue Growth: Double-digit YoY growth with operating efficiency.

- Diversified Revenue Streams: From subscriptions, merchant solutions, and fintech.

- AI + Data Stack Integration: Aligns Shopify with tech peers like Amazon and Meta.

- High Institutional Confidence: Surged post-AI roadmap announcements.

A Shift in E-Commerce Investment Focus

Shopify’s expansion reflects a broader shift in e-commerce investment, from standalone web tools to comprehensive, AI-powered ecosystems. This evolution not only secured its place among tech’s elite but also made Shopify an indispensable part of how modern commerce functions globally.

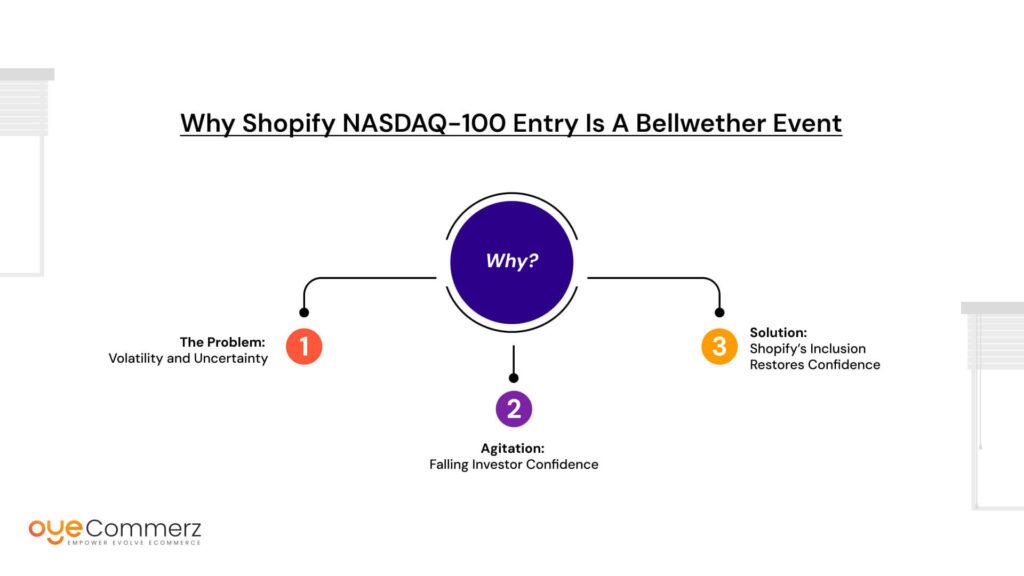

Why Shopify NASDAQ-100 Entry Is a Bellwether Event

The e-commerce sector faced significant volatility in the years following the pandemic. While digital retail thrived during lockdowns, the post-COVID economy brought new headwinds. Stock valuations became unstable, and investor sentiment turned cautious.

The Problem: Volatility and Uncertainty

By late 2023, e-commerce equities saw stagnation. Inflationary pressures, shifting consumer behavior, and saturated platform markets caused many digital-first companies to lose favor with investors. Several once-promising platforms failed to sustain pandemic-era growth, leading to widespread skepticism.

Agitation: Falling Investor Confidence

Even strong players weren’t immune. With rising interest rates and weakened purchasing power, many institutional investors began pulling back from the e-commerce space. Funds became more conservative, leaning into large-cap tech and blue-chip equities. For investors, the once-booming digital commerce sector seemed like a risky bet.

Solution: Shopify’s Inclusion Restores Confidence

Recent Shopify NASDAQ-100 entry, however, marks a critical turning point. More than symbolic, it signals institutional validation. It tells investors that Shopify isn’t just a pandemic-era beneficiary, it’s a long-term infrastructure play in digital commerce.

Index inclusion is more than a label. It forces automatic buying by passive funds and ETFs tracking the NASDAQ-100. This increases liquidity, reduces volatility, and boosts valuation stability.

How Institutional Investors Interpret This Move

- Index inclusion = trustworthiness: Institutions often see it as a benchmark of stability and scale.

- Automated allocation: Funds re-balance to include new entries, driving stock momentum.

- Increased analyst coverage: Entry to a major index often boosts visibility and media exposure.

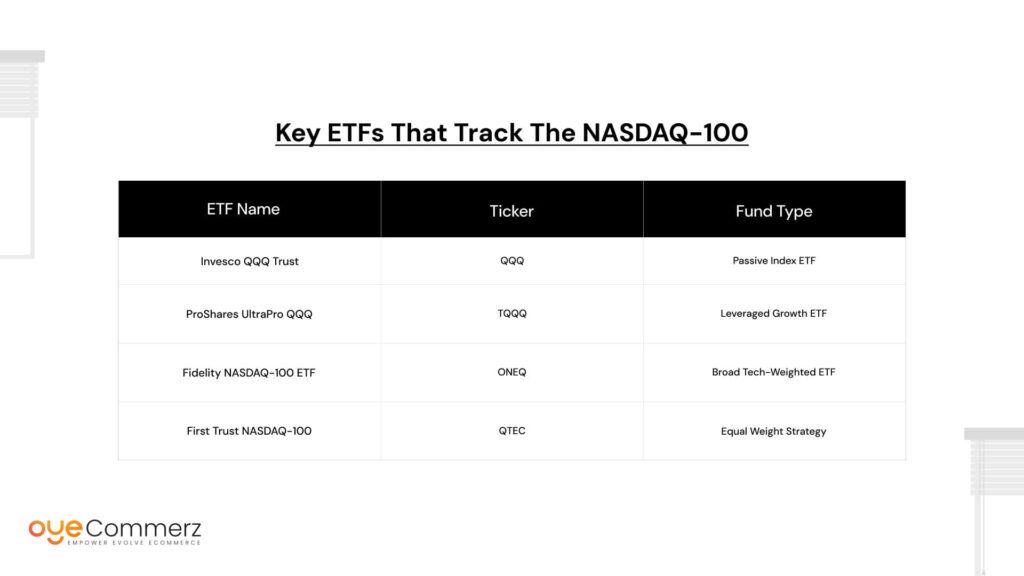

Key ETFs That Track the NASDAQ-100

These funds now hold Shopify by default, increasing institutional exposure, a vital marker in a shift in e-commerce investment across global portfolios.

The Shift in E-Commerce Investment Strategy: Explained

The inclusion of Shopify NASDAQ-100 status underscores a deeper transformation, a strategic pivot in how investors approach e-commerce. It’s no longer about betting on high growth at any cost. Today, institutional capital is flowing toward platforms with clear profitability pathways, real infrastructure, and scalable services.

From Growth-at-All-Costs to Profitability and Fundamentals

For years, e-commerce investing was dominated by a “land grab” mentality. Investors prioritized revenue growth over earnings. But rising interest rates, macroeconomic tightening, and cash burn have changed the narrative. Now, profitability, cash flow stability, and enterprise value take center stage.

Platforms that operate lean and deliver consistent earnings have become more attractive. The shift isn’t temporary, it reflects a new era of financial discipline in digital commerce.

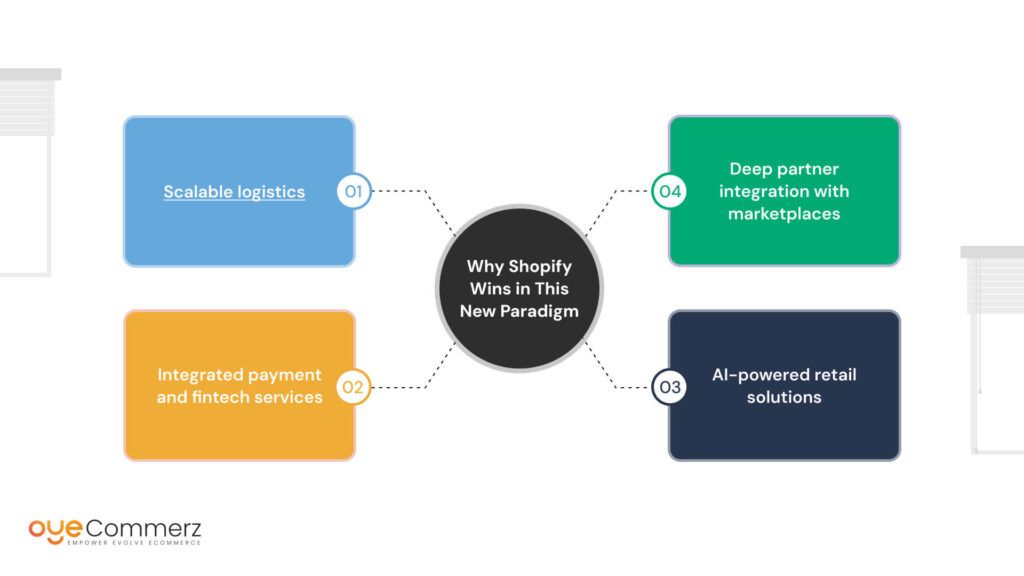

Why Shopify Wins in This New Paradigm

Unlike smaller SaaS e-commerce startups, Shopify has evolved into a full-service ecosystem. It offers:

- Scalable logistics (Shopify Fulfillment Network)

- Integrated payment and fintech services (Shopify Payments, Capital)

- AI-powered retail solutions (Shopify Magic, Sidekick)

- Deep partner integration with marketplaces like Amazon, Walmart

These offerings make Shopify more than a storefront provider, it’s an operational backbone for global retailers. That makes it investment-grade in a risk-aware market.

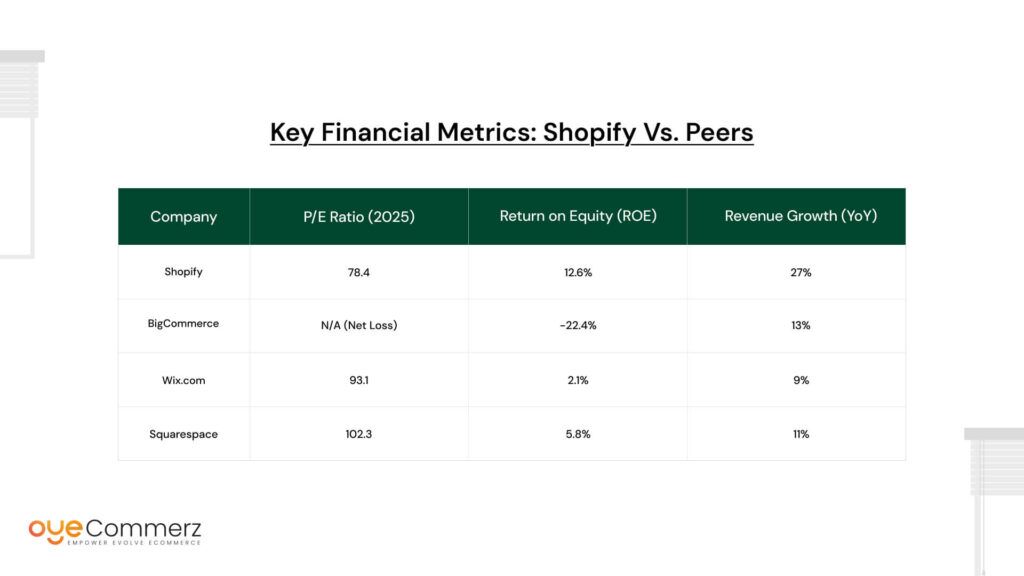

Divergence: Shopify vs. Smaller SaaS Platforms

Smaller platforms often lack diverse revenue streams or infrastructure depth. They’re more vulnerable to churn, ad spend fluctuations, and tech redundancy. Shopify, on the other hand, has durability and vertical integration, which de-risk its earnings model.

This divergence explains why Shopify NASDAQ-100 inclusion is more than symbolic, it’s proof of strategic positioning.

Key Financial Metrics: Shopify vs. Peers

This shift in e-commerce investment proves that durable platforms with scalable infrastructure, like Shopify, are now the cornerstone of institutional strategies. It marks a broader shift in e-commerce investment preferences, from speculative to strategic.

The Domino Effect on the E-Commerce Industry

Shopify NASDAQ-100 inclusion does more than elevate a single company, it sets a new benchmark across the e-commerce landscape. Investors, founders, and market analysts are recalibrating what success looks like in this evolving sector.

New Benchmarks, New Expectations

With Shopify’s performance and ecosystem depth now in the spotlight, investor expectations have shifted. There’s increasing pressure on both public and private e-commerce companies to demonstrate:

- Profitability over raw growth

- Infrastructure maturity, not just front-end solutions

- Long-term value creation, not quarterly spikes

This recalibration forces emerging platforms to match or mirror Shopify’s strategic hybrid model, combining SaaS innovation with operational infrastructure.

IPOs and VC Investment Reactions

The public markets are reacting with caution but clarity. Post-pandemic IPOs from e-commerce firms like Rent the Runway or Allbirds faced volatile outcomes due to narrow business models. Now, venture capital firms are redirecting capital flows toward startups that:

- Offer logistics or payment integrations

- Build long-term B2B or omnichannel capabilities

- Present solid EBITDA and cash runway plans

The Shift in E-Commerce Investment is evident here, investors now demand both narrative and numbers.

Shopify as a Strategic Blueprint

Startups in the D2C and SaaS commerce space are increasingly building Shopify-like models. This means developing:

- Modular architecture for merchant scalability

- Proprietary logistics or white-label fulfillment

- Embedded fintech and financing tools

Shopify has redefined what it means to be an e-commerce platform: not a tool, but a growth partner.

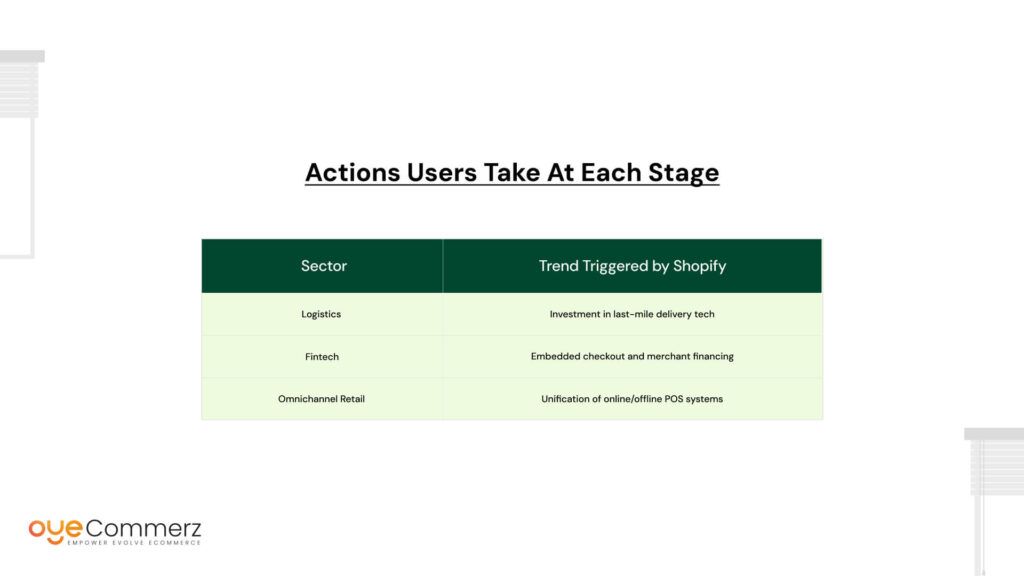

Ripple Effects Across the Ecosystem

Shopify’s model has sparked a domino effect across:

As Shopify cements its position within the NASDAQ-100, it rewrites the playbook for the entire e-commerce ecosystem. From venture funding strategies to omnichannel infrastructure bets, the ripple effects are both vast and deep, marking a fundamental shift in e-commerce investment direction.

Passive Investment Funds: A Driving Force Post Inclusion

Passive investing is a foundational pillar of U.S. financial markets, accounting for more than half of all equity fund assets. Rather than actively picking stocks, these funds track specific indexes, like the NASDAQ-100, and automatically allocate capital to their components.

How Passive Investing Works

Passive funds, including ETFs (Exchange-Traded Funds) and index mutual funds, are structured to mirror an index’s holdings in proportion. For example, when a company enters the NASDAQ-100, all ETFs tracking that index must purchase the stock to stay aligned with its composition. This creates predictable, large-scale demand.

Shopify NASDAQ-100 Status and $1T+ Fund Access

With Shopify NASDAQ-100 inclusion, it now qualifies for exposure through over $1 trillion in assets tied to passive vehicles. This translates to automated capital inflows, regardless of day-to-day performance or market sentiment.

Some of the most influential passive funds adjusting to include Shopify are:

- Invesco QQQ Trust (QQQ)

- ProShares Ultra QQQ (QLD)

- Fidelity NASDAQ Composite ETF (ONEQ)

- First Trust NASDAQ-100 Equal Weighted Index Fund (QQEW)

These adjustments not only diversify Shopify’s shareholder base but also enhance long-term stability.

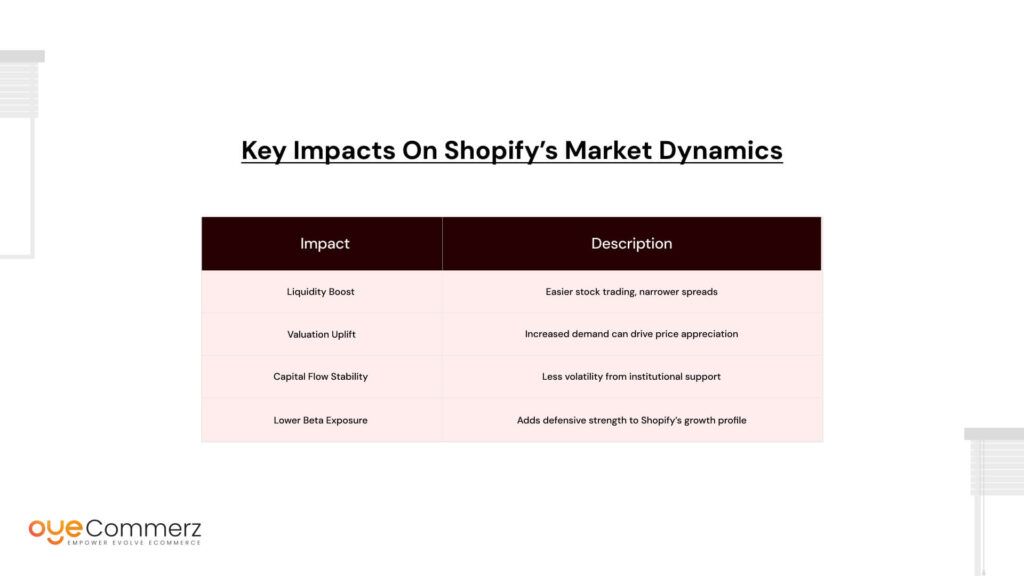

Key Impacts on Shopify’s Market Dynamics

The result of such large-scale passive fund inclusion is a significant financial tailwind:

These factors, collectively, bolster Shopify’s standing as a resilient, high-value asset.

Passive investing isn’t just about tracking, it’s about reinforcing winners. Shopify NASDAQ-100 status ensures that it now rides the tailwinds of institutional capital, further validating the shift in e-commerce investment behavior towards infrastructure-rich, scalable platforms.

Shopify’s Competitive Leverage: Now and Beyond

Being part of the NASDAQ-100 isn’t just a badge of honor, it’s a powerful advantage in today’s hyper-competitive tech market. For Shopify, this milestone elevates it from a strong platform to a trusted powerhouse in global e-commerce.

Branding That Speaks Volumes

The NASDAQ-100 is home to giants like Apple, Amazon, and Microsoft. Now, Shopify stands among them, signaling to the world: “We’re not just here, we’re built to last.”

This elite status boosts:

- Investor confidence; aligning Shopify with blue-chip credibility

- Customer trust; small and large businesses feel safer choosing Shopify

- Global recognition; becoming a household name across sectors

Real-World Strategic Advantages

Being in the NASDAQ-100 offers Shopify more than just visibility, it opens real doors:

- Partnership deals: Brands now see Shopify as a long-term infrastructure partner

- Talent acquisition: Top engineers and product minds prefer working with industry leaders

- Investor attraction: Institutional funds now automatically include Shopify, boosting inflows

These benefits are already reflected in market signals:

- Search volume for “Shopify stock” rose by 31% in the week following inclusion (Source: Google Trends)

- API integration demand increased by 22% across B2B developer tools post-announcement

- Shopify App Store downloads surged as merchants ramp up usage

Built for the Future

This momentum aligns with Shopify’s long-term innovation roadmap:

- Expanding AI commerce tools for personalized shopping

- Strengthening its logistics and fulfillment network

- Growing its fintech ecosystem through Shop Pay and capital lending

The NASDAQ-100 spotlight isn’t just symbolic, it sharpens Shopify’s edge across branding, trust, and innovation. With its feet firmly in the index and its eyes on the future, Shopify is positioned to lead the shift in e-commerce investment, not just ride it.

Preparing for What’s Next: Investor Strategies Post-Inclusion

Shopify NASDAQ-100 inclusion is more than news, it’s a signal. For both institutional and retail investors, this is the time to act with insight, not impulse.

Smart Strategies for the Savvy Investor

Whether you’re a seasoned fund manager or an everyday trader, here are actionable strategies post-inclusion:

Track Technical Indicators:

Shopify’s trading volume spiked 18% after inclusion. Watching 50-day and 200-day moving averages can offer trend confirmation signals. A golden cross (when the 50-day crosses above the 200-day) is particularly bullish.

Use Volume Breakouts

Look for unusual volume surges, especially post-announcements. Shopify’s past earnings releases have triggered 10–15% swings in either direction.

Monitor Institutional Holdings:

As passive funds buy-in, expect greater institutional accumulation. Platforms like NASDAQ and Morningstar track this. An increase in ownership >65% typically reflects long-term support.

Evaluate the Next Big Entrants

If you’re looking to spot the next “Shopify,” analyze companies that:

- Are NASDAQ-listed

- Have a $15B+ market cap

- Show consistent YoY revenue growth

- Are deeply embedded in SaaS, e-commerce, or B2B enablement

Potential followers of Shopify’s path include:

- Wix (web infrastructure)

- BigCommerce (mid-market e-commerce)

- Block (fintech + merchant tools)

- SquareSpace (digital storefronts for creators)

These companies mirror Shopify’s multi-service e-commerce model and are watched closely by institutional funds.

Investing after an index inclusion means balancing the momentum of institutional inflows with the fundamentals of business performance. Shopify NASDAQ-100 move is a milestone, not the finish line. Track, analyze, and diversify.

Risks and Realities: Not All That Glitters…

Despite Shopify’s bullish momentum, no investment story is without challenges. It’s essential to temper enthusiasm with pragmatic caution.

Key Macroeconomic Risks

- Consumer Spending Slowdown:

Inflation, wage stagnation, and student debt burdens affect e-commerce purchase frequency. - Rising Interest Rates:

Rate hikes increase the cost of capital for both investors and e-commerce merchants. - Global Competition:

Giants like Amazon and TikTok Shop are pouring resources into logistics and social commerce, increasing pressure on Shopify’s merchant base.

Shopify’s Internal Vulnerabilities

- SMB Dependence:

Over 80% of Shopify’s customer base is small-to-mid-sized businesses, which are highly vulnerable to economic shocks. - Marketplace Gaps:

Shopify still lacks a full-scale marketplace equivalent to Amazon’s. Discovery and customer acquisition remain merchant responsibilities. - Scalability Risks:

As it diversifies into AI and fintech, integration issues could slow product innovation or dilute focus.

Stay Grounded, Stay Informed

Being part of the NASDAQ-100 doesn’t mean Shopify is shielded from market turbulence. Investors should evaluate quarterly performance, innovation velocity, and competitive positioning, beyond just index alignment.

Shopify NASDAQ-100 status is a promising indicator, but not a guarantee. Wise investors embrace the potential while preparing for the pitfalls.

Ready to Ride the E-Commerce Momentum?

Partner with OyeCommerz to scale smarter with expert Shopify services.

As Shopify NASDAQ-100 inclusion reshapes global investment flows, now is the time to future-proof your digital store. Whether you’re starting fresh or upgrading your current setup, our tailored Shopify services help you unlock growth, optimize operations, and stay ahead in the evolving retail landscape.

Let’s build your e-commerce success story, powered by Shopify, elevated by OyeCommerz.

Contact to Migrate your Site to Shopify Now

Conclusion

Shopify’s NASDAQ-100 inclusion marks a pivotal moment in the evolution of e-commerce investing. This milestone not only reflects Shopify’s robust financial health and strategic growth but also validates a clear shift in e-commerce investment from speculative growth to sustainable profitability. As institutional investors recalibrate their portfolios, the focus increasingly favors platforms offering comprehensive infrastructure and innovation, qualities that Shopify exemplifies through its expanding Shopify services ecosystem.

For investors and industry watchers alike, this signals the importance of staying alert to such transformative market shifts. Understanding these trends will empower smarter decisions in a rapidly changing digital commerce landscape.

Understand. Invest. Lead the Future of Digital Commerce.

Frequently Asked Questions

AI-driven personalization, omnichannel retail, sustainable logistics, and profitability-focused investment strategies are dominating e-commerce in 2025.

Shopify is redefining digital retail with its AI-powered tools, embedded fintech, and growing global logistics network, now amplified by its NASDAQ-100 inclusion.

Shopify focused on expanding cross-border commerce, enhancing mobile UX, and integrating advanced analytics to support merchant growth.

You can track live Shopify stats using the Shopify Admin Dashboard, third-party analytics tools, or by visiting platforms like BuiltWith and Store Leads.

As of early 2025, e-commerce accounts for approximately 22.6% of total global retail sales, reflecting steady digital adoption across markets. (Statista)