Shopify Payment Gateway Integration Services

Smooth payment experiences are essential for converting visitors into loyal customers. At Oyecommerz, we specialize in integrating Shopify Payment Gateways that align with your business needs, ensuring secure, seamless transactions that scale with your eCommerce growth.

What You Can Achieve with the Right Shopify Payment Gateway Integration Partner

Partnering with a Shopify expert like Oyecommerz for payment gateway integration brings numerous advantages. We streamline your payment processes, ensuring your customers can checkout quickly and securely. With our services, you can integrate multiple payment options, local and international payment methods, and currencies that suit your target audience. This builds trust and increases the conversion rate by reducing cart abandonment. Furthermore, our payment solutions are PCI-compliant, offering robust security features that protect sensitive customer data. With our seamless Shopify integration, you can focus on growing your business, while we ensure every transaction is efficient and secure.

Our Shopify Payment Gateway Integration Services

Multi-payment Gateway Setup

Easily integrate multiple payment gateways like PayPal, Stripe, and more for local and international customers.

Secure Payment Solutions

Ensure PCI compliance and protect sensitive customer payment information with secure integrations.

Currency Conversion

Enable automatic currency conversion for a smooth shopping experience for international customers.

Subscription Payments

Integrate recurring payment solutions to manage subscriptions effortlessly.

Mobile Payment Integration

Seamlessly accept mobile payments with Apple Pay, Google Pay, and more.

Custom Payment Gateway

Develop custom payment solutions tailored to your specific business needs.

Business Benefits of Shopify Payment Gateway Integration Services

Improved Customer Experience

Fast and secure payments reduce friction during checkout.

Increased Conversion Rates

Offering multiple payment methods reduces cart abandonment.

Global Reach

Support for multicurrency and local payment gateways allows global scalability.

Data Security

PCI-compliant integration ensures safe and secure transactions.

Operational Efficiency

Automation of payment processes reduces manual work, saving time and costs.

Analytics and Reporting

Track payment data to improve decision-making and growth strategies.

Why Choose Oyecommerz for Shopify Payment Gateway Integration Services?

Official Shopify Experts

We are certified Shopify experts with deep technical expertise in Shopify Plus integrations.

Custom Solutions

We offer tailored payment gateway solutions that fit your specific business needs, no matter the size.

Quick Turnaround Time

Our team ensures fast and seamless payment gateway setup so you can start accepting payments immediately.

PCI-Compliant Integrations

We provide fully secure, PCI-compliant payment gateway integration for peace of mind.

Multicurrency Support

Our integration services include multicurrency support to help you expand your global reach.

Continuous Support

From initial setup to ongoing maintenance, we provide continuous support for all your payment needs.

Our Shopify Payment Gateway Integration Process

Requirement Analysis

Understanding your business needs and payment preferences.

Payment Gateway Selection

Choosing the most suitable payment gateway for your store.

Integration Setup

Seamless integration with Shopify Plus using secure APIs.

Security Compliance

Ensuring PCI compliance and secure transaction processing.

Testing & Validation

Rigorous testing to ensure a flawless payment experience.

Ongoing Support

Providing continuous monitoring, support, and updates.

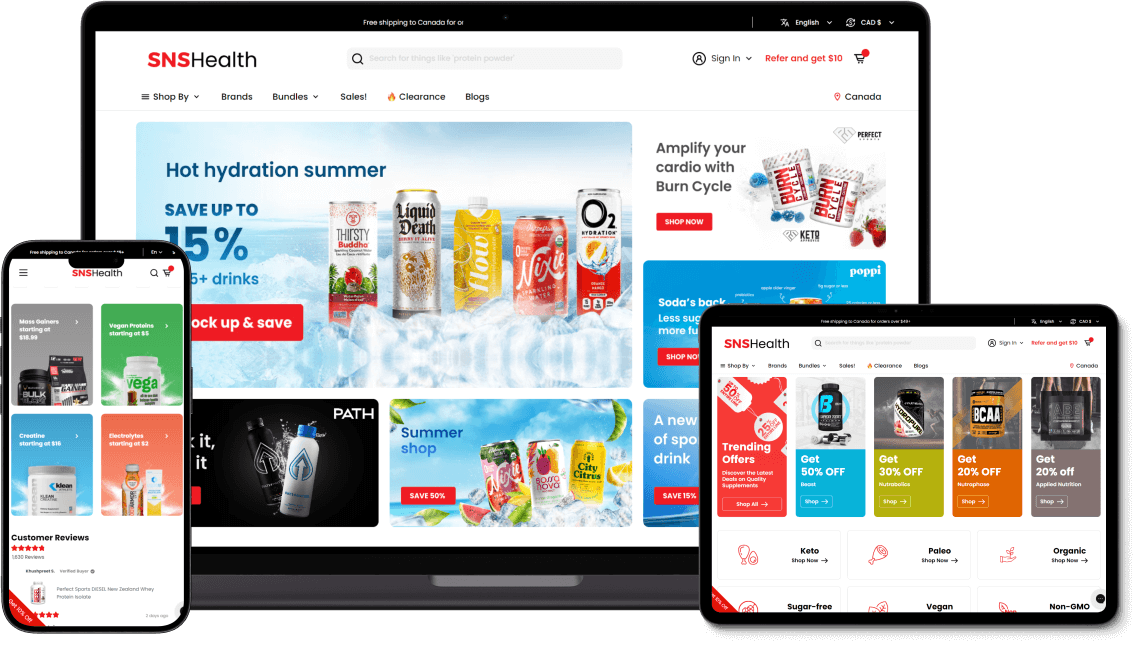

PORTFOLIO

Health & Wellness

Witness a staggering 140% increase in organic orders. Our strategic SEO for SNS Health, a leading e-commerce platform in vitamins and supplements, catalyzed unprecedented sales growth. Experience the power of expert optimization with OyeCommerz.

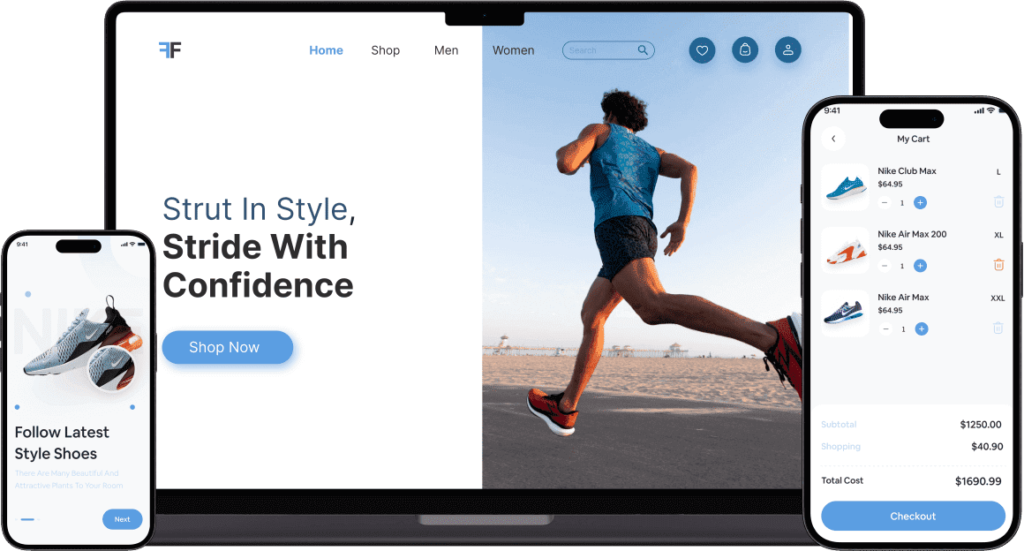

Fashion & Apparel

OyeCommerz orchestrated a seamless transition to Shopify for Fashion Forward Footwear, revamping their web presence and elevating their upscale shoe boutique with modern design, swift loading times, and simplified purchasing processes.

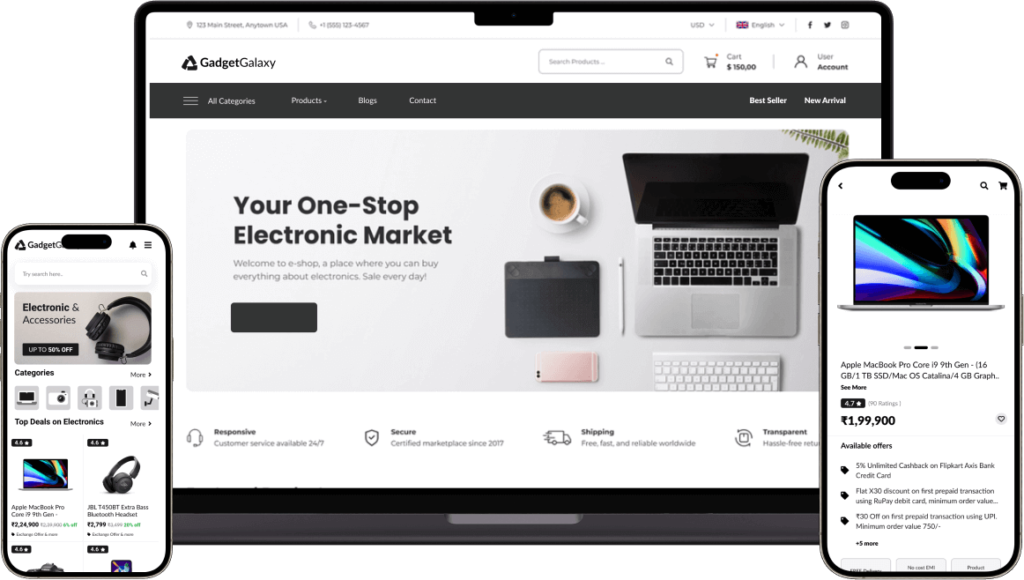

Electronics & Gadgets

OyeCommerz revitalized GadgetGalaxy Store through comprehensive Shopify Audit and Integration Services, addressing outdated product listings and enhancing mobile optimization

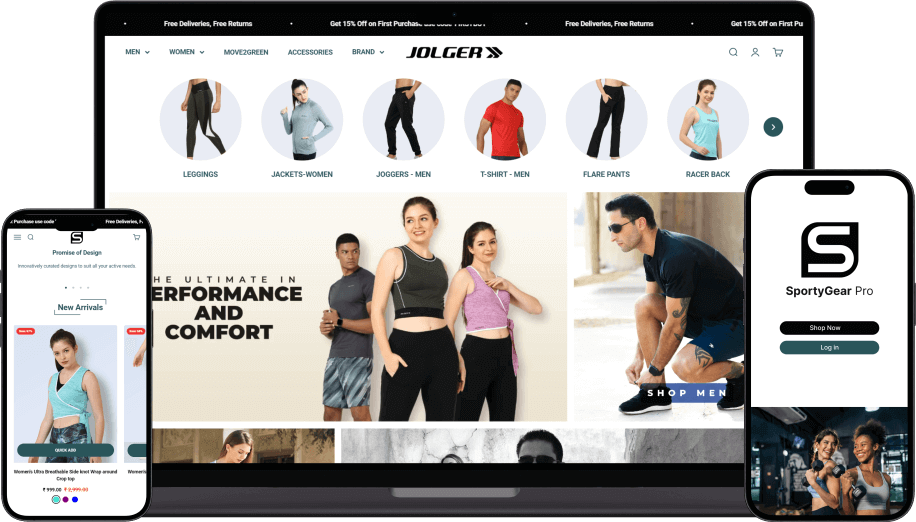

Sports & Outdoors

SportyGear Pro's online presence underwent a transformation as OyeCommerz created and integrated dynamic and user-friendly Shopify store that revolutionized the sports gear buying experience.

Industries We Cater

Fashion & Apparel

Seamless integration of fashion stores with multicurrency support for international buyers.

Health & Wellness

Enable secure payments for recurring orders and subscription-based services.

Food & Beverage

Optimize payment solutions for both online orders and in-store pickups.

Electronics

Ensure secure, high-value transactions for electronics and gadget stores.

Home & Furniture

Provide multiple payment options for high-ticket items and installment purchases.

Beauty & Skincare

Simplify recurring payments for subscription boxes and beauty services.

Automotive

Ensure secure payment solutions for automotive parts and accessories businesses.

Sports & Fitness

Implement seamless payments for subscription-based fitness services.

Jewelry & Luxury Goods

Enable secure transactions for high-value purchases with fraud protection.

Toys & Games

Provide easy checkout experiences for both one-time and recurring orders.

Pet Supplies

Ensure smooth payment experiences for subscription-based and one-time pet supply purchases.

Books & Media

Integrate mobile and online payments for seamless transactions.

Gift Shops

Offer multicurrency payments and gift card integration for special occasions.

Automotive Parts

Secure high-value payments and installments for spare parts.

Digital Products

Offer secure transactions for digital downloads and subscriptions.

Education & Courses

Enable secure recurring payments for course subscriptions and e-learning platforms.

Elevate Your E-commerce with Our Shopify API Integration Services

Start Your Shopify Integration Today!

Engagement Models OyeCommerz Supports

Tailored Excellence in Shopify Amazon Integration Solutions

At OyeCommerz, our unwavering commitment extends to crafting customized solutions that elevate your Shopify Amazon integration journey to remarkable success. Regardless of the scale and complexity of your business, we immerse ourselves in comprehending your integration project, aligning it seamlessly with your core objectives, and ensuring it delivers maximum benefits. With our adaptable Shopify Amazon integration frameworks, you can confidently focus on your strengths while we meticulously craft and deliver personalized solutions.

Adaptability for Unique Integration Challenges

Our Shopify Amazon integration frameworks are meticulously engineered to accommodate a diverse spectrum of project requirements, even those with distinctive and complex demands. Our adept professionals collaborate seamlessly to develop integrated strategies that precisely cater to the unique requirements of our global clientele spanning various industries and sectors.

Agile Adaptation through Time and Material Mastery

In scenarios involving integration projects with evolving scopes and dynamic demands, our Time and Material Model shines. This adaptable model seamlessly adjusts to shifting integration dynamics, facilitating agile milestone creation and swift project modifications. Payments are transparently based on hours worked, providing you with the flexibility needed to adeptly manage team size, expenses, and resources to accommodate the fluctuations of the market.

Adaptability for Unique Integration Challenges

Our Shopify Amazon integration frameworks are meticulously engineered to accommodate a diverse spectrum of project requirements, even those with distinctive and complex demands. Our adept professionals collaborate seamlessly to develop integrated strategies that precisely cater to the unique requirements of our global clientele spanning various industries and sectors.

What Our Clients Say About Us

300+ Client reviews

Payment Gateway Statistics

Shopify offers a robust selection of over 100 payment gateways globally, providing merchants with the flexibility to choose the best fit for their business needs. One of the critical factors influencing cart abandonment, which averages around 70.19%, is payment-related issues. By integrating a reliable payment gateway, merchants can significantly reduce this rate by offering secure and transparent payment options. The cost of integrating a payment gateway varies by provider, but Shopify Payments, the default gateway, does not charge additional transaction fees. Security and compliance are paramount, with integrated payment gateways employing advanced encryption and authentication protocols to prevent fraud and ensure adherence to legal and financial regulations, such as PCI-DSS.

Additionally, Shopify payment gateways support multiple currencies and payment methods, including credit/debit cards, digital wallets, and even cryptocurrencies, enhancing global reach. The integration process is straightforward, with Shopify Payments setup involving just a few steps in the Shopify admin panel. These features underscore the importance of selecting the right payment gateway to build customer trust and improve the overall shopping experience on a Shopify store.

Other Service we Provide

Shopify Plus Development Services

Oyecommerz specializes in Shopify Plus development, offering custom solutions to scale enterprise-level e-commerce businesses, streamline workflows, and integrate advanced functionalities for enhanced customer experience and operational efficiency.

Shopify Plus Design Services

Our Shopify Plus design services focus on creating responsive, high-performance websites tailored for enterprise brands, enhancing user experience with visually appealing, conversion-focused designs to drive engagement and sales.

Shopify App Development

We develop custom Shopify apps to extend store functionality, integrate third-party services, and automate business processes, ensuring your e-commerce platform meets unique operational needs and scales with growth.

Shopify Theme Development

Oyecommerz offers tailored Shopify theme development, creating visually stunning, conversion-optimized themes that align with your brand identity, enhance customer experience, and offer seamless functionality across all devices.

Shopify Web Development

Our Shopify web development services include building robust, scalable e-commerce websites with custom features, integrations, and advanced security, ensuring a seamless shopping experience and operational efficiency for your online store.

Shopify SEO Services

We offer Shopify SEO services to boost your store’s online visibility, drive organic traffic, and improve rankings, using best practices and data-driven strategies to maximize search engine performance and conversions.

Shopify B2B Development Services

Oyecommerz provides specialized Shopify B2B development services, enabling wholesale functionality, bulk ordering, and advanced inventory management, designed to support and scale B2B e-commerce operations effectively.

Shopify Migration Services

Our Shopify migration services ensure a seamless transition from other platforms to Shopify, securely migrating your store’s data, products, and customers while optimizing for improved functionality and performance.

FAQs about Shopify Payment Gateway Integration Services

The best payment gateway depends on your business needs, but popular options include Shopify Payments for seamless integration, PayPal for global reach, and Stripe for flexibility. Consider factors like transaction fees, ease of setup, and supported currencies.

Integration typically takes 1-2 weeks, depending on the complexity of your requirements and the payment gateway chosen. Our team ensures a smooth and quick setup to get you up and running efficiently.

Costs vary based on the payment gateway and any additional customization needed. Basic integrations may range from $500 to $2,000. For detailed pricing, contact us to get a quote tailored to your needs.

Yes, Shopify supports international payments. You can integrate gateways that handle multiple currencies and international transactions to reach a global audience.

Shopify payment gateways are PCI-compliant, meaning they adhere to strict security standards to protect customer data. Features include encryption, secure tokenization, and fraud prevention tools.

Refunds can be managed directly through your Shopify admin. You can process refunds for orders, including partial refunds, and manage return requests efficiently through your Shopify dashboard.

Yes, you can integrate mobile payment options such as Apple Pay, Google Pay, and others, to offer your customers a convenient and secure checkout experience.

Shopify supports a wide range of currencies. You can set up your store to accept payments in multiple currencies, making it easier to cater to international customers.

In the event of a payment gateway failure, transactions may be temporarily interrupted. We provide ongoing support and monitoring to quickly address and resolve any issues to minimize downtime.

Shopify allows you to configure tax settings based on your location and sales regions. You can set up automatic tax calculations and manage transaction fees through your payment gateway settings.

You can integrate multiple payment gateways into your Shopify store to offer various options like credit cards, PayPal, Apple Pay, and more. This flexibility can enhance the customer experience and increase conversions.

Yes, we can integrate both local and international payment gateways to suit your business needs. This ensures that you can cater to customers from different regions with their preferred payment methods.

A custom payment gateway allows for tailored solutions that fit your specific business requirements, such as unique transaction processes, additional security features, or integration with other business systems.

Streamline the checkout process, offer multiple payment options, and ensure that your payment gateway integration is smooth and secure. Providing a fast, easy, and trusted checkout experience can significantly reduce cart abandonment rates.

We ensure PCI compliance by integrating payment gateways that meet PCI DSS standards. We also provide guidance on best practices for maintaining security and compliance throughout your payment processes.

Yes, we can integrate installment payment solutions to allow customers to pay in installments. This can help increase sales by making higher-priced items more accessible to customers.

Shopify handles currency conversion through payment gateways that support multicurrency transactions. Customers can view prices in their local currency, and payments are processed accordingly.

Yes, Shopify supports subscription-based payment models through various apps and integrations, allowing you to offer recurring billing for products or services.

Recurring payments can be set up using Shopify apps designed for subscriptions. These apps manage the billing cycles and automate the payment process for your subscription-based products or services.

We offer ongoing support including monitoring, troubleshooting, and updates to ensure your payment gateway integration continues to function smoothly. Our team is available to assist with any issues that may arise.

We use PCI-compliant payment gateways and robust encryption technologies to handle large-scale transactions securely. Our solutions are designed to manage high volumes of transactions efficiently while maintaining data security.

Yes, we can integrate multiple payment gateways to support global operations. This includes options for various currencies and regional payment preferences to cater to your international customer base.

We start with a needs assessment, followed by design and development of the custom solution. After integration, we conduct thorough testing and validation before providing ongoing support and maintenance.

Shopify’s payment gateways are designed to handle high-value transactions securely. We ensure that your integration is optimized for performance and security to manage large transactions efficiently.

Yes, we can integrate advanced fraud prevention systems with Shopify payments to detect and prevent fraudulent activities, ensuring the security of transactions and protecting your business.

We integrate payment solutions that provide a consistent experience across web, mobile, and in-store channels. This includes unified checkout processes and synchronized payment systems.

Shopify Plus can support international tax systems through its advanced tax settings and integrations. We can configure your store to handle complex tax scenarios across different regions.

Shopify provides built-in reporting tools for tracking payment data. We can also integrate additional analytics solutions to provide detailed insights into payment performance and customer behavior.

Yes, Shopify Plus is designed to handle high volumes of transactions efficiently, making it suitable for large enterprise-level businesses with substantial payment processing needs.

We offer comprehensive ongoing maintenance and support services, including regular updates, troubleshooting, and performance optimization to ensure your payment gateway continues to meet your business needs.