As an existing Squarespace business owner, you know how important it is to keep your customers happy and your sales steady. But with growing expectations for flexible payment options like Buy Now, Pay Later (BNPL) or cryptocurrency, it’s crucial to ask: Is your platform doing enough?

Squarespace and Shopify are two popular e-commerce platforms, but when it comes to payment flexibility, Shopify is the clear leader. Whether it’s offering multiple payment gateways, multi-currency support, or advanced fraud protection, Shopify empowers businesses like yours to grow and adapt.

If you’re considering how to level up your store, it might be time to move from Squarespace to Shopify and explore the difference better payment options can make!

Table of Contents

ToggleWhy Expanding Payment Options Is Crucial for US Businesses

Picture this: a customer fills up their cart with your amazing products, heads to checkout, and—bam—they leave because their preferred payment option isn’t available. That’s a lost sale you could’ve avoided. In fact, research shows that 17% of US shoppers abandon their carts when they don’t find a payment method they trust.

For modern businesses, especially those targeting Gen Z and millennials, payment flexibility isn’t just nice to have—it’s a must. These digital-savvy shoppers expect smooth, secure, and diverse payment options. Whether it’s Apple Pay, Buy Now Pay Later (BNPL) plans, or even cryptocurrency, the more options you offer, the more likely they are to hit Buy Now.

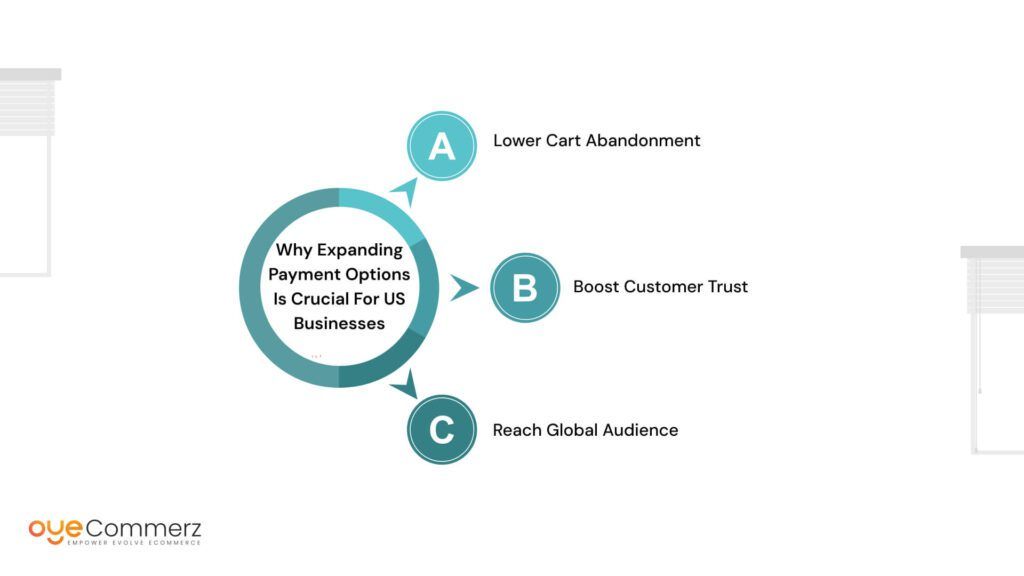

Here’s how expanding your payment options can make a difference:

- Lower Cart Abandonment: Simplify checkout with flexible options, and watch more customers complete their purchases.

- Boost Customer Trust: Payment methods like PayPal and credit card security features help build confidence, especially for first-time buyers.

- Reach Global Audience: Multi-currency support and international gateways open doors to customers worldwide, broadening your market.

Adding these options isn’t just about convenience; it’s about creating a shopping experience that feels effortless and reliable. By making payment choices easy and accessible, you’re not just increasing sales—you’re building a loyal customer base that comes back for more.

If you’re ready to grow, ask yourself: is your current platform supporting these needs? If not, it might be time to upgrade.

Challenges Squarespace Users Face with Limited Payment Options

When running an online business, offering the right payment options is critical to meeting customer expectations and boosting sales. For Squarespace users, however, limited payment flexibility can lead to significant challenges. Let’s dive into the hurdles that come with these restrictions.

Difficulty in Catering to International Customers

Expanding globally is a dream for many entrepreneurs, but Squarespace’s limited payment capabilities make this harder than it should be. With no multi-currency support, international customers often face the inconvenience of seeing prices in a foreign currency. This not only creates confusion but also makes potential buyers think twice before completing their purchase. For US-based businesses aiming to grow internationally, this is a major roadblock that could shrink your global customer base.

Missed Sales Opportunities Due to Lack of BNPL Options

The rise of Buy Now, Pay Later (BNPL) services like Affirm and Afterpay has completely changed how people shop. These options let customers split payments over time, making high-ticket purchases feel more affordable. Unfortunately, Squarespace doesn’t support BNPL solutions natively, which means missed opportunities to convert price-conscious shoppers. For businesses selling premium products, this limitation can lead to abandoned carts and lower revenue.

Impact on Customer Trust and Retention

Shoppers today value choice and convenience. When they can’t use their preferred payment method, it not only causes frustration but also impacts how they perceive your brand. A lack of diverse payment options can make your business appear outdated or less reliable compared to competitors. Over time, this may erode customer trust and make it harder to retain loyal buyers.

Why This Matters

Squarespace’s limited offerings may be fine for small or local businesses, but they’re not enough for entrepreneurs with big aspirations. The inability to cater to global shoppers, support BNPL, or provide diverse payment options can hold your business back.

If you’re struggling with these challenges, it might be time to consider a platform that prioritizes payment flexibility—like Shopify. With tools to enhance customer trust, expand internationally, and boost sales, Shopify helps you overcome these limitations and take your business to the next level.

Overview of Payment Options in Shopify and Squarespace

When it comes to choosing an e-commerce platform, payment options play a huge role in shaping your customer experience and boosting sales. Let’s take a closer look at what Shopify and Squarespace offer so you can decide which platform suits your business best.

Shopify Payment Options

Shopify shines when it comes to payment flexibility. With Shopify Payments, you get a built-in solution that supports credit cards, Apple Pay, and Google Pay right out of the box. This makes setting up payments super easy, even for first-time entrepreneurs.

Need more options? Shopify integrates with over 100 payment gateways, including popular names like PayPal, Stripe, and Authorize.net. So, whether your customers prefer traditional methods or modern digital wallets, Shopify has you covered.

For businesses targeting younger, tech-savvy shoppers, Shopify also supports Buy Now, Pay Later (BNPL) options like Affirm and Afterpay. These options make it easier for customers to afford big-ticket items by spreading payments over time.

And let’s not forget cryptocurrency support. While not built-in, Shopify allows seamless integration with third-party gateways like Coinbase Commerce, giving you access to an entirely new customer base.

With Shopify, payment flexibility doesn’t just enhance convenience—it expands your growth potential by catering to a broader audience.

Squarespace Payment Options

Squarespace, on the other hand, keeps things pretty basic. It supports PayPal, Stripe, and Apple Pay, which are reliable but limited options. For many business owners, this simplicity might feel restrictive, especially if you’re looking to scale or offer more innovative payment methods.

Unlike Shopify, Squarespace doesn’t natively support Buy Now, Pay Later services or cryptocurrency. That means fewer payment options for customers who value flexibility, which can impact conversion rates.

For US-based entrepreneurs looking to reach global customers or offer tailored payment plans, these limitations might become a roadblock.

While Squarespace keeps it simple, Shopify stands out as the go-to platform for payment flexibility and scalability. From multi-gateway support to modern options like BNPL and cryptocurrency, Shopify ensures your customers can pay how they want, when they want.

If you’re serious about growth, switching to Shopify could be the upgrade your store needs to meet today’s shopper expectations!

Technical Comparison of Payment Integrations

When it comes to payment integrations, both Shopify and Squarespace have their strengths. But if you’re planning to grow your business, understanding the technical details can help you make the right choice. Let’s break it down.

Ease of Setup

Shopify is designed with user-friendliness in mind. Its intuitive dashboard makes setting up payment gateways a breeze, even for non-tech-savvy users. Whether you’re using Shopify Payments or connecting third-party gateways like PayPal or Stripe, the process is straightforward. You can enable multiple options at once, giving your customers more ways to pay without the hassle.

Squarespace, on the other hand, takes a simpler approach. It limits you to just a few options—PayPal, Stripe, and Apple Pay. While the setup is quick and easy, it doesn’t offer the same level of flexibility. If your business needs more advanced payment solutions, you might feel stuck.

Transaction Fees

One of Shopify’s biggest perks is Shopify Payments, which eliminates third-party fees for many transactions. This can significantly cut costs, especially for high-volume businesses. For those using other gateways, Shopify charges an additional fee (ranging from 0.5% to 2%) depending on your plan.

Squarespace doesn’t have a native payment system, so you’ll rely on third-party gateways like PayPal or Stripe. These come with their own transaction fees, which can quickly add up. Unlike Shopify, there’s no option to reduce costs by using a built-in solution.

Scalability

Shopify is built to grow with your business. Whether you’re processing 100 orders or 10,000, Shopify’s robust infrastructure handles high-volume transactions without slowing down. It also supports advanced features like multi-currency payments and regional tax calculations, making it perfect for scaling globally.

Squarespace, while great for small businesses, has limitations. Its payment integrations aren’t designed to handle the complexities of a rapidly growing store. For entrepreneurs with big ambitions, this can be a bottleneck.

If you’re looking for a platform that’s easy to use, cost-effective, and scalable, Shopify is the winner. Its advanced payment integrations and flexibility ensure you’re ready for growth. Squarespace may work for simpler setups, but for entrepreneurs aiming high, Shopify’s technical edge is hard to beat.

Advanced Payment Features: Shopify’s Advantage Over Squarespace

In today’s e-commerce world, offering advanced payment features isn’t just about convenience—it’s about staying ahead of the competition. Shopify outshines Squarespace by delivering cutting-edge tools that empower businesses to grow and thrive.

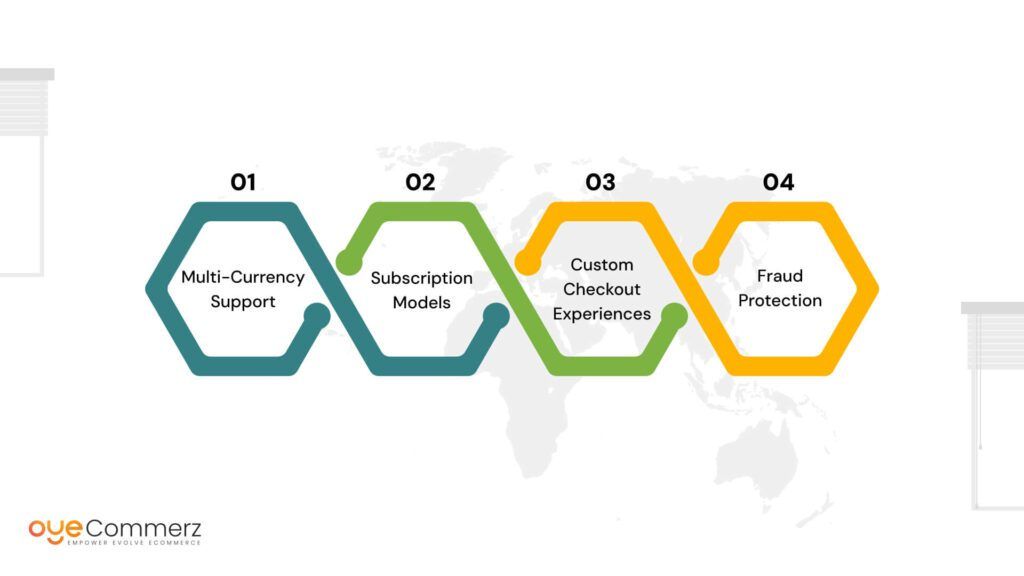

Multi-Currency Support

Expanding globally? Shopify has your back. Its built-in multi-currency support automatically converts prices based on your customer’s location. This makes international shopping feel seamless and builds trust with buyers who prefer to pay in their local currency. Squarespace, unfortunately, doesn’t have automatic currency conversion, which can be a dealbreaker for global businesses.

Subscription Models

Recurring payments are the lifeblood of subscription-based businesses, and Shopify makes them easy. With apps like Recharge and Bold Subscriptions, you can set up subscription models for products or services in minutes. Whether it’s weekly coffee deliveries or monthly fitness memberships, Shopify offers the flexibility to create consistent revenue streams. Squarespace, however, lacks native support for subscriptions, limiting options for entrepreneurs who want to tap into this growing market.

Custom Checkout Experiences

Shopify takes personalization to the next level with customizable checkout experiences through Shopify Plus. You can tweak everything from layout to branding, creating a checkout process tailored to your customers’ preferences. This doesn’t just look good—it helps reduce cart abandonment. Squarespace offers a fixed checkout experience that’s functional but far less flexible, which may not suit businesses with unique needs.

Fraud Protection

Security is non-negotiable in e-commerce, and Shopify delivers with advanced fraud protection tools. Its fraud analysis system flags suspicious orders, providing key insights like billing mismatches or IP address discrepancies. This proactive approach helps keep your business and customers safe. Squarespace, while secure, doesn’t offer the same level of fraud detection, leaving businesses with fewer safeguards.

Why It Matters

These advanced payment features are more than extras—they’re essential for modern businesses. From global reach to personalized checkouts and subscription options, Shopify ensures you’re equipped to meet evolving customer expectations. Squarespace, while reliable for basic needs, simply can’t match Shopify’s flexibility and innovation.

If you’re ready to scale, build trust, and stay competitive, Shopify’s advanced payment tools might be exactly what your business needs.

How Shopify Supports US-Based Businesses with Payment Solutions

Shopify offers an unmatched suite of payment solutions designed to help US-based businesses thrive in the fast-paced world of e-commerce. From customization to seamless integration, Shopify ensures that your payment system works for your business, not against it.

Shopify Plus for Enterprise-Level Customization

For businesses that are scaling quickly or handling high-volume transactions, Shopify Plus is a game-changer. It offers enterprise-level customization, allowing you to tailor payment processes to fit your unique needs. Whether you want to design a checkout flow that aligns with your brand or integrate exclusive payment options like Buy Now, Pay Later (BNPL), Shopify Plus provides the flexibility to make it happen.

Integration with Accounting Tools

Managing payments goes beyond processing transactions. Shopify seamlessly integrates with popular accounting tools to help you manage taxes, generate financial reports, and streamline bookkeeping. For US-based businesses, this is particularly helpful in navigating complex sales tax regulations. Tools like QuickBooks and Xero work in harmony with Shopify, ensuring that your financial management is as smooth as your payment process.

24/7 Support for Payment Gateway Troubleshooting

Technical issues with payment gateways can disrupt sales and damage customer trust. Shopify’s 24/7 support ensures that help is always available, whether you’re troubleshooting payment errors or setting up a new gateway. Their knowledgeable team is just a call or chat away, so you can resolve issues quickly and keep your store running smoothly.

Contact to Migrate your Squarspace Website to Shopify Now

Conclusion

For US-based entrepreneurs, expanding payment options isn’t just a convenience it’s a necessity for staying competitive, improving customer satisfaction, and increasing conversions. Shopify’s advanced tools, seamless integrations, and 24/7 support make it the ideal platform to future-proof your e-commerce store.

If you’re tired of limitations holding your business back, now is the time to make the switch. Migrating to Shopify ensures you’re equipped with the best tools for seamless payment management and growth. Why settle for less when success is just a platform away?

Frequently Asked Questions

- Can I integrate custom payment gateways on Shopify?

Absolutely! Shopify supports custom payment gateways, allowing you to offer unique payment solutions tailored to your business needs. Whether you want to integrate a regional payment processor or experiment with cryptocurrency payments, Shopify’s robust API and app ecosystem make it simple to set up. - How do transaction fees compare between Shopify and Squarespace?

Shopify often has lower transaction fees, especially if you use Shopify Payments, which eliminates additional gateway fees. Squarespace, on the other hand, relies on third-party processors like Stripe and PayPal, which may charge higher fees per transaction. For businesses with high sales volume, Shopify’s transparent and scalable fee structure can make a big difference in profitability. - Does Shopify support international payment methods?

Yes, Shopify is designed for global businesses. It supports multi-currency transactions, over 100 payment gateways worldwide, and alternative payment methods like Buy Now, Pay Later (BNPL). This makes it easy to cater to international customers and expand your reach. With automatic currency conversion and fraud prevention tools, Shopify ensures a smooth and secure checkout experience for customers everywhere.