Over 4.8 million eCommerce businesses run on Shopify—and with global eCommerce sales expected to hit $6.3 trillion in 2025, cross-border selling isn’t optional anymore. But when it comes to getting paid internationally, one key question keeps coming up: Shopify Payments vs Stripe—what’s better for your business?

Choose the wrong one, and you could be losing money to hidden fees, facing cart abandonment due to checkout issues, or struggling with delayed payouts. For international sellers, these mistakes can cost thousands in revenue—or worse, reputation.

In this guide, we’ll dive deep into Shopify Payments vs Stripe, comparing their features, fees, ease of use, and performance for international transactions. Whether you’re just starting out or scaling globally, you’ll know exactly which one fits your business—and why.

Ecommerce Basics for Beginners

If you’re new to selling online, it’s easy to feel overwhelmed by terms like “payment gateways,” “processing fees,” or “multi-currency support.” But understanding these fundamentals is essential—especially when comparing options like Shopify Payments vs Stripe.

What is a Payment Gateway?

A payment gateway is a service that authorizes and processes payments for online stores. It acts as a bridge between your customer’s credit card and your bank account, ensuring secure transactions.

Payment Gateway vs Payment Processor

Though often used interchangeably, they’re not the same. A payment processor handles the technical side of the transaction (communication between banks), while a gateway authorizes the transaction and transfers payment details securely.

Shopify Payments is both a processor and a gateway, built directly into Shopify. Stripe, on the other hand, is a powerful third-party processor that can also act as a gateway when integrated with your store.

Why International Payment Compatibility Matters

When you’re selling across borders, your payment system must handle:

- Multiple currencies

- Localized payment methods

- Conversion fees

- Fast and secure international payouts

Delays, unsupported currencies, or payment failures can lead to abandoned carts and lost trust—especially from international customers.

Key Terms You’ll See in This Guide

To help you navigate the comparison of Shopify Payments vs Stripe, here’s a quick glossary:

- Transaction Fee: Charged per sale by your payment provider.

- Currency Conversion Fee: Extra cost for accepting payments in a foreign currency.

- Payout Schedule: How quickly you receive your money after a sale.

- Chargeback: A reversal of funds by the buyer’s bank—often due to disputes or fraud.

- Multi-Currency Support: The ability to accept and settle payments in different currencies.

Understanding the Shopify Ecosystem

Shopify offers a fully hosted ecommerce platform. Shopify Payments is its native gateway, which integrates seamlessly. Stripe is a third-party option that requires additional setup but offers more customization and global reach. Understanding these platforms is key to making the right decision as your business grows.

What is Shopify Payments?

When comparing Shopify Payments vs Stripe, it’s important to first understand what each platform offers individually. Let’s start with Shopify Payments—Shopify’s built-in payment gateway.

Overview of Shopify Payments

Shopify Payments is the default payment processor for Shopify stores. It eliminates the need for third-party integrations, allowing merchants to manage orders, payments, and payouts all within the Shopify dashboard.

It’s designed for simplicity and speed—offering a streamlined setup and fully integrated reporting tools, which is especially helpful for merchants who want an all-in-one ecommerce solution.

Supported Countries

Shopify Payments is available in major regions including the United States, Canada, United Kingdom, Australia, and select parts of Europe and Asia. However, it is not yet available globally, which can limit access for some international merchants.

Currency Support

Shopify Payments supports multi-currency transactions, allowing you to sell in local currencies while settling in your own. This feature is crucial for international sellers, reducing friction during the checkout process.

Key Benefits of Shopify Payments

- Seamless Integration: Works natively with your Shopify admin—no extra plugins or redirects.

- Faster Payouts: U.S. merchants typically receive funds within 2 business days.

- No Transaction Fees: If you use Shopify Payments, you avoid the additional transaction fees Shopify charges for third-party gateways like Stripe.

- Built-in Fraud Detection: Includes tools to monitor and manage chargebacks and suspicious activity.

Limitations of Shopify Payments

- Limited Country Support: Not available in many regions where Stripe is.

- Account Holds: Like many payment processors, it can freeze funds during disputes or suspicious activity.

- Strict Approval Criteria: Certain industries (like supplements or CBD) may not be eligible.

In the Shopify Payments vs Stripe debate, Shopify Payments is ideal for sellers who want a simplified, integrated setup without third-party complexity—especially if they are operating in supported countries.

What is Stripe?

To fully evaluate Shopify Payments vs Stripe, it’s essential to understand Stripe on its own—especially because it’s one of the most widely used payment solutions across the web.

Overview of Stripe

Stripe is a powerful third-party payment processor that supports online payments for businesses of all sizes. Unlike Shopify Payments, which is exclusive to the Shopify platform, Stripe can be integrated into virtually any ecommerce platform, mobile app, or custom website.

It’s known for its flexibility, developer-friendly tools, and support for a wide range of payment methods across more than 135 currencies.

Supported Countries

Stripe is available in over 45 countries and serves businesses in many global markets where Shopify Payments is not yet supported. This gives it an edge for sellers looking to operate in diverse international regions.

Currency and Payment Method Support

Stripe allows merchants to accept payments in multiple currencies and supports a wide variety of payment methods, including:

- Credit/debit cards

- Apple Pay, Google Pay

- Bank debits and transfers (ACH, SEPA, etc.)

- Local payment methods (iDEAL, Alipay, etc.)

This flexibility is a key factor when comparing Shopify Payments vs Stripe for international ecommerce.

Key Benefits of Stripe

- Global Reach: Accept payments in more currencies and countries than Shopify Payments currently supports.

- Advanced Customization: Use APIs and developer tools to build highly tailored payment experiences.

- Recurring Billing: Robust support for subscriptions and recurring billing.

- Detailed Reporting: In-depth analytics and financial data for growth tracking.

Limitations of Stripe

- Requires More Setup: Integration with Shopify is not native and may need developer assistance.

- Additional Transaction Fees: Shopify charges an extra fee when using Stripe instead of Shopify Payments.

- Steeper Learning Curve: For non-technical users, Stripe’s feature-rich dashboard can be overwhelming.

In the Shopify Payments vs Stripe comparison, Stripe stands out for sellers who prioritize flexibility, broader global support, and advanced functionality—even if it comes at the cost of a more complex setup.

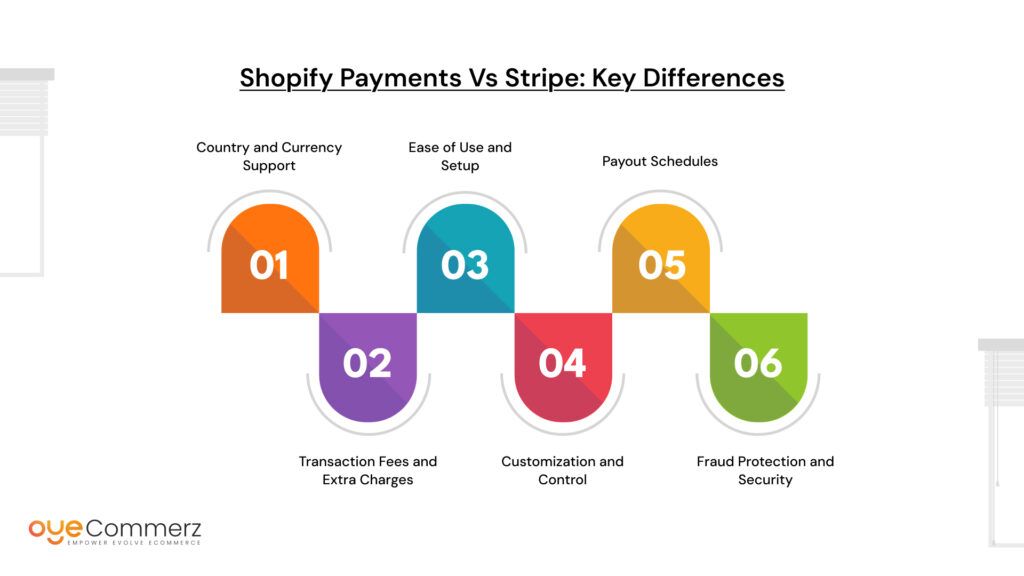

Shopify Payments vs Stripe: Key Differences

Now that we’ve explored both platforms individually, it’s time to compare them side by side. The choice between Shopify Payments vs Stripe depends on several factors—including where you sell, how much customization you need, and what level of control you want over the checkout experience.

Here are the key differences every international seller should know.

1. Country and Currency Support

Stripe has a wider global footprint than Shopify Payments. If you’re selling in regions where Shopify Payments isn’t available, Stripe may be your only option. However, for U.S.-based sellers targeting major international markets, Shopify Payments covers most high-demand territories.

2. Transaction Fees and Extra Charges

Using Shopify Payments means you won’t pay additional transaction fees on top of Shopify’s standard credit card rates. But if you choose Stripe, Shopify will charge an extra fee per transaction (0.5% to 2%, depending on your plan). Stripe’s international and currency conversion fees can also add up quickly if not managed carefully.

3. Ease of Use and Setup

Shopify Payments is plug-and-play. It’s automatically set up within your Shopify dashboard, which is ideal for beginners. Stripe, while highly flexible, typically requires more time to integrate and may need developer support—especially if you’re customizing payment flows or using it outside the Shopify platform.

4. Customization and Control

Stripe wins when it comes to flexibility. It’s highly customizable via APIs, making it ideal for developers or businesses with complex payment needs. Shopify Payments is more standardized, which keeps things simple but limits advanced customization.

5. Payout Schedules

Both platforms offer relatively fast payouts, but Shopify Payments usually processes funds within 2 business days for U.S. merchants. Stripe’s payout schedule varies by country and business type, ranging from 2 to 7 days on average.

6. Fraud Protection and Security

Both Stripe and Shopify Payments offer strong fraud protection tools, including automatic flagging of suspicious transactions and dispute resolution. Stripe offers more advanced tools like machine learning fraud detection, while Shopify Payments focuses on ease-of-use with built-in risk management.

Contact to Migrate your Site to Shopify Now

Comparison Table Preview

Which One is Better for International Sellers?

When deciding between Shopify Payments vs Stripe, international sellers need to weigh more than just fees or ease of use. Your business model, target regions, and technical requirements all play a role in choosing the right solution.

Here’s how to break it down based on your specific needs.

If You’re Based in the U.S. but Sell Internationally

Shopify Payments is an excellent choice for U.S.-based merchants selling to customers in countries where Shopify supports multi-currency. It offers fast payouts, a smooth checkout experience, and no additional transaction fees. However, if you plan to expand into countries not supported by Shopify Payments, you may hit limitations.

If Your Business Sells to Markets Not Supported by Shopify Payments

In this case, Stripe becomes the more flexible option. It supports a wider range of countries and local payment methods, making it ideal for sellers expanding into regions like Southeast Asia, Eastern Europe, or Latin America. Stripe also allows for more localization, which can boost conversions in unfamiliar markets.

If You Need High Customization

Stripe is the better fit. Its developer-first approach means you can create a fully tailored payment flow, integrate with custom apps, and manage everything from recurring billing to platform-based payments. Shopify Payments, while simpler, lacks that level of flexibility.

If You Prioritize Simplicity and Speed

Go with Shopify Payments. It’s easy to set up, completely integrated with your Shopify dashboard, and handles everything from fraud prevention to reporting without requiring developer support. It’s a hassle-free option for sellers who want to focus on growing their brand, not managing backend systems.

Tips to Optimize for International Transactions

- Enable multi-currency support in Shopify if using Shopify Payments.

- Use local payment methods via Stripe for better regional conversion rates.

- Monitor conversion fees and payout times regularly to protect profit margins.

- Ensure your checkout page is localized and mobile-optimized.

In the ongoing comparison of Shopify Payments vs Stripe, the best choice comes down to your expansion strategy. If you want simplicity and you’re selling in supported regions, Shopify Payments is hard to beat. If you need flexibility, global reach, or advanced payment handling, Stripe delivers the tools to scale internationally with confidence.

Common Challenges International Sellers Face

Selling to a global audience opens up massive growth potential—but it also brings added complexity to payments, logistics, and compliance. Whether you’re choosing between Shopify Payments vs Stripe or planning to use both strategically, it’s important to understand the most common hurdles international sellers face.

Currency Conversion Confusion

Handling multiple currencies sounds simple in theory, but can lead to major headaches. Some payment gateways convert currencies automatically but charge high conversion fees. Others settle payments in a single currency, creating accounting challenges.

- Shopify Payments allows multi-currency checkout, but payouts are still settled in your base currency.

- Stripe offers more flexibility with multi-currency settlements, but setup may require technical know-how.

Legal and Compliance Barriers

Each country has its own financial regulations, tax rules, and compliance requirements. Failing to meet these can result in delayed payouts, frozen accounts, or legal issues.

- Shopify Payments handles most tax reporting and compliance in supported countries.

- Stripe offers detailed documentation but leaves much of the compliance responsibility to the merchant.

Long Payout Timelines

Cash flow is critical for growing businesses, especially when managing international orders, inventory, and marketing costs. Delayed payouts can disrupt operations.

- Shopify Payments typically offers faster payouts in the U.S. (around 2 business days).

- Stripe’s payout times vary by region, and may extend to 7 days or more in certain markets.

High Transaction and Conversion Fees

International sales often come with hidden costs, including cross-border transaction fees, conversion rates, and third-party charges.

- Shopify Payments eliminates Shopify’s transaction fees when used as the default gateway.

- Stripe charges standard processing fees, and Shopify adds an extra transaction fee unless you’re using Shopify Payments.

Chargebacks and Fraud Risks

Global transactions carry a higher risk of chargebacks, especially if you’re accepting unfamiliar payment methods or shipping to high-risk regions.

- Both Shopify Payments and Stripe offer fraud detection and chargeback management tools.

- Stripe provides more customizable fraud protection through its Radar system, while Shopify Payments simplifies risk management for the average merchant.

Understanding these challenges is key when comparing Shopify Payments vs Stripe. The best solution for your business depends on how prepared you are to manage the complexities of global payments, and which platform aligns better with your operational goals.

Conclusion

When it comes to Shopify Payments vs Stripe, there’s no one-size-fits-all answer—only what fits your business best.

If you’re a U.S.-based merchant selling in supported countries and want a fast, seamless setup with lower fees and fewer moving parts, Shopify Payments is the smarter option. It’s optimized for Shopify, removes third-party complexity, and keeps your operations simple.

But if you’re scaling globally, selling in regions not covered by Shopify Payments, or need a more advanced and flexible payment infrastructure, Stripe offers the customization and reach to support your long-term growth.

The best choice depends on your current needs, future expansion plans, and technical resources. Evaluate where your customers are, what level of control you need, and how you want to manage your transaction costs.

Frequently Asked Questions

No, you cannot use both simultaneously for credit card processing. If you enable Shopify Payments, Stripe will be automatically disabled as a direct payment gateway. However, you can still use Stripe for other payment methods like SEPA or ACH via manual setup.

Yes. If you choose Stripe over Shopify Payments, Shopify applies an additional transaction fee (ranging from 0.5% to 2%) depending on your Shopify plan. This is in addition to Stripe’s own processing fees.

Both platforms support multi-currency transactions, but Shopify Payments offers a more native experience within the Shopify dashboard. Stripe offers broader settlement options and more flexibility for advanced multi-currency setups, especially for custom or headless stores.

Yes. Stripe is available in over 45 countries, including several regions where Shopify Payments is not yet supported. This makes Stripe a better option for merchants selling in emerging or less common markets.

Shopify Payments generally offers faster payouts for U.S. sellers—usually within 2 business days. Stripe’s payout timeline varies depending on the country and risk profile but typically ranges between 2 and 7 business days.

Yes, you can switch from Stripe to Shopify Payments through your Shopify admin settings. However, customer card data cannot be directly transferred due to PCI compliance rules, so subscription-based or stored card businesses should plan the switch carefully.