In today’s digital-first economy, more than 57% of Shopify merchants are now selling products internationally. However, nearly 60% of them admit to facing challenges with understanding and managing tax regulations when expanding into new markets.

Selling globally offers unlimited growth potential — but also invites a complex world of tax obligations. As soon as your Shopify store crosses borders, you’re no longer just dealing with U.S. sales tax. You’re suddenly navigating VAT in Europe, GST in Australia, import duties in Asia, and thresholds that can trigger legal compliance overnight.

Tax compliance isn’t optional. Failure to collect, report, or remit taxes properly can lead to penalties, customer dissatisfaction, and even store shutdowns. Unfortunately, Shopify doesn’t always automate everything you need, especially when dealing with multi-country transactions.

This blog is here to simplify what often feels overwhelming. Whether you’re a first-time store owner or scaling globally from Magento or WooCommerce, we’ll walk you through the tax regulations you need to know, how Shopify handles them, where the gaps are, and how to plug them — without the headaches.

Table of Contents

ToggleE-Commerce Taxes 101: A Beginner’s Crash Course

If you’re new to online selling, the idea of managing tax regulations can seem daunting. But understanding the basics is essential — especially if you’re selling on a platform like Shopify, which makes it easier but not entirely foolproof.

What Are Tax Regulations in E-Commerce?

Tax regulations refer to the legal requirements imposed by governments to collect taxes on goods and services sold. In e-commerce, this primarily includes:

- Sales Tax (in the U.S.)

- VAT (Value Added Tax) in the EU

- GST (Goods and Services Tax) in countries like Canada, Australia, and India

- Customs Duties on international shipments

Each region has its own tax system, registration thresholds, and reporting obligations. What works for a domestic sale in California may be completely different for a customer in Germany or Australia.

Sales Tax vs. VAT: What’s the Difference?

Understanding the key difference between sales tax and VAT is critical:Sales tax is typically a one-time charge added at checkout, while VAT is embedded in the product price and affects how pricing is displayed in different markets.

Why Shopify Sellers Need to Understand Tax Regulations

Shopify does offer built-in tools to help you collect taxes, but it’s up to you to configure them correctly. If you sell across multiple states or internationally, failing to comply with local tax regulations could lead to:

- Under-collection or overcharging customers

- Fines or tax audits from international tax authorities

- Delayed shipments due to customs complications

Getting Started with Shopify’s Tax Settings

Here are a few beginner steps to set up taxes on your Shopify store:

- Set up your store’s origin address – This determines your default tax location.

- Enable automatic tax collection – Shopify supports automatic calculations for the U.S., Canada, EU, and others.

- Manually review tax settings by region – Especially important for countries with VAT/GST.

- Track where you have tax obligations (nexus) – If you sell a high volume in certain states or countries, you may be legally required to register there.

Understanding the basics of tax regulations is your first step toward building a legally compliant, scalable e-commerce business. As you grow, the rules become more complex — but with the right foundation, you’re already ahead.

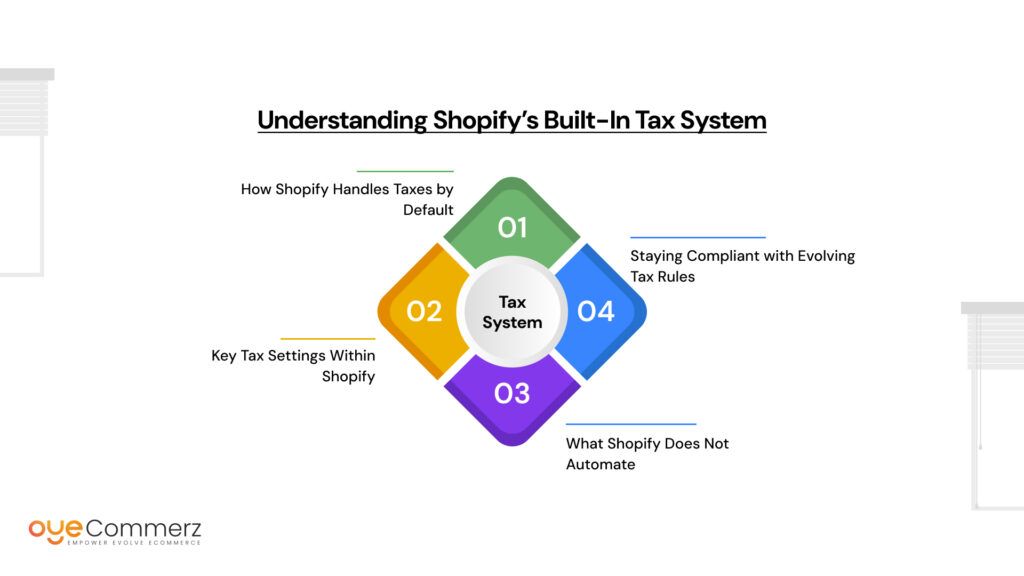

Understanding Shopify’s Built-in Tax System

Shopify makes it easier for merchants to stay compliant with basic tax regulations, but it’s important to understand what it does — and doesn’t — do for you. Its automated tools can save time, but you still need to configure them correctly and monitor for changes in tax laws.

How Shopify Handles Taxes by Default

When you set up your store, Shopify automatically enables default tax settings based on your business address and the markets you serve. It calculates taxes at checkout based on:

- The customer’s shipping address

- Product type and taxability

- Region-specific tax rules (e.g., U.S. sales tax vs. EU VAT)

Shopify updates these rates regularly, especially for jurisdictions with dynamic tax changes like the United States and the European Union.

Key Tax Settings Within Shopify

To comply with tax regulations across regions, here are the core areas to review inside your Shopify dashboard:

- Automatic Tax Calculations

Shopify supports auto-calculated tax rates for:

- United States (state and local)

- Canada (GST/HST/PST/QST)

- European Union (VAT)

- Australia and New Zealand (GST)

- United States (state and local)

- Tax Overwrites and Manual Configuration

You can override automatic settings to:

- Set custom rates for specific products or regions

- Exempt certain items (like food or digital goods, where applicable)

- Configure tax-exempt customer groups (e.g., nonprofits or B2B buyers)

- Set custom rates for specific products or regions

- Product-Specific Tax Settings

Not all products are taxed equally. Shopify allows you to:

- Mark products as taxable or non-taxable

- Apply special rates or exemptions

- Choose whether tax is included in the price or added at checkout

- Mark products as taxable or non-taxable

- Shipping Tax Settings

Depending on your location, shipping charges may also be taxable. Shopify allows you to configure these settings regionally to comply with tax regulations.

What Shopify Does Not Automate

While Shopify handles tax calculations, it does not:

- Register your business with tax authorities (e.g., state tax departments or foreign tax agencies)

- File or remit taxes on your behalf

- Monitor your physical or economic nexus thresholds

- Manage custom reporting requirements in non-supported regions

For more advanced compliance — especially when selling in multiple states or countries — you may need third-party tools or expert help to fully align with tax regulations.

Staying Compliant with Evolving Tax Rules

Global tax regulations are constantly evolving. New thresholds, digital services rules, and trade agreements can affect your obligations overnight. Shopify helps keep you current with standard changes, but ultimate responsibility rests with the merchant.

Regularly reviewing your tax settings and consulting with professionals can help prevent costly errors and ensure your store operates smoothly as it expands.

U.S. Tax Compliance on Shopify: The Essentials

For U.S.-based Shopify merchants, understanding how tax regulations apply across different states is essential to staying compliant and avoiding costly penalties. Unlike many countries that apply a national sales tax, the United States has a state-by-state system — making tax collection and reporting more complex for e-commerce businesses.

What Is Sales Tax Nexus?

One of the most important concepts in U.S. tax compliance is nexus — the legal connection between your business and a state that requires you to collect sales tax there.

There are two primary types of nexus:

- Physical Nexus: You have a physical presence in the state — such as an office, warehouse, employee, or inventory stored (e.g., through fulfillment centers).

- Economic Nexus: You exceed a certain number of sales or revenue in a state, even without a physical presence.

- Example: In many states, $100,000 in sales or 200 transactions annually triggers nexus.

- Example: In many states, $100,000 in sales or 200 transactions annually triggers nexus.

Once nexus is established, you’re required to register with that state’s tax authority and begin collecting and remitting sales tax.

How Shopify Helps You Stay Compliant

Shopify simplifies sales tax collection through built-in features that align with state-level tax regulations:

- Automatic U.S. Sales Tax Calculation: Shopify calculates sales tax based on the customer’s shipping address and your store’s nexus settings.

- Nexus Management: You can manually enter the states where you have nexus. Shopify will then apply the correct rates at checkout.

- Tax Reports: Shopify provides tax summary reports to help you file returns accurately, though it does not file taxes for you.

Setting Up Sales Tax in Shopify: Step-by-Step

- Navigate to Settings > Taxes and Duties

- Set Your Origin Address: This determines where your business is based.

- Add States Where You Have Nexus: Shopify will only collect taxes where you indicate a tax obligation.

- Collect Tax on Shipping (If Required): In some states, shipping is taxable. Shopify allows you to enable this option per region.

- Enable Automatic Tax Calculations: Let Shopify manage rate updates across jurisdictions.

Common Mistakes to Avoid

- Failing to Monitor Economic Nexus: Shopify doesn’t track this automatically. Use a third-party tool or monitor sales volume in each state regularly.

- Assuming Shopify Files Taxes for You: Shopify only collects and reports — it’s your responsibility to file returns.

- Incorrect Product Taxability: Not all items are taxable (e.g., clothing in some states, digital products, or food). Be sure to set product tax codes appropriately.

When to Use Third-Party Tax Tools

If your business sells in multiple states or expects rapid growth, third-party tax automation platforms like TaxJar, Avalara, or Quaderno can offer:

- Automatic nexus tracking

- State registration assistance

- Auto-filing of returns

- Detailed compliance alerts

While Shopify covers the basics, growing businesses often require more advanced compliance tools to stay fully aligned with U.S. tax regulations.

International Sales Tax Compliance: Selling Globally Without Headaches

Expanding your Shopify store to international markets opens up vast opportunities, but it also introduces a complex set of tax regulations that vary widely across countries. Unlike the U.S., many countries impose a value-added tax (VAT), goods and services tax (GST), or other forms of indirect taxation that Shopify merchants must understand to avoid penalties and delays.

Key International Taxes to Know

- VAT (Value Added Tax): Common across the European Union and many other countries, VAT is charged on most goods and services. It is usually included in the sale price and must be collected, reported, and remitted to the appropriate tax authorities.

- GST (Goods and Services Tax): Used in countries like Canada, Australia, and New Zealand, GST operates similarly to VAT but with its own rules and thresholds.

- Customs Duties and Import Taxes: When shipping products internationally, customs duties may apply, depending on the product type, value, and destination country. These are often collected separately from sales taxes but affect your customers’ total cost and shipping process.

Managing VAT and GST on Shopify

Many countries require foreign sellers to register for VAT or GST once they surpass specific sales thresholds. This means Shopify merchants must:

- Register for tax purposes in each applicable country or region.

- Charge the correct VAT or GST rate at checkout.

- Submit periodic VAT/GST returns to the tax authorities.

For example, the European Union recently introduced the One-Stop Shop (OSS) and Import One-Stop Shop (IOSS) schemes, designed to simplify VAT reporting for cross-border e-commerce sales. Shopify supports these mechanisms but requires correct setup by the merchant.

Pricing Strategies: Tax-Inclusive vs. Tax-Exclusive

Different countries have different consumer expectations and legal requirements around pricing display:

- In many countries, prices must be tax-inclusive, meaning VAT or GST is included in the listed price.

- In the U.S., prices are typically shown tax-exclusive, with sales tax added at checkout.

Configuring your Shopify store to display prices correctly depending on the market helps maintain transparency and compliance with local tax regulations.

Shipping and Customs Compliance

International shipping introduces customs documentation and potential duties that affect both sellers and buyers. Understanding the harmonized tariff codes, duties, and import restrictions of your target countries is vital.

Failing to manage customs taxes can result in delayed shipments, returned goods, or unexpected costs for customers, damaging your brand reputation.

Using Shopify to Manage International Tax Regulations

Shopify supports automatic calculation of VAT and GST in many countries but does not handle registration, filing, or remittance. Merchants selling globally should:

- Configure tax settings per region correctly.

- Stay informed of threshold changes and new regulations.

- Consider specialized tax automation tools or consult experts for complex markets.

By proactively managing international tax regulations, you can expand your Shopify store’s global reach with confidence and avoid costly compliance pitfalls.

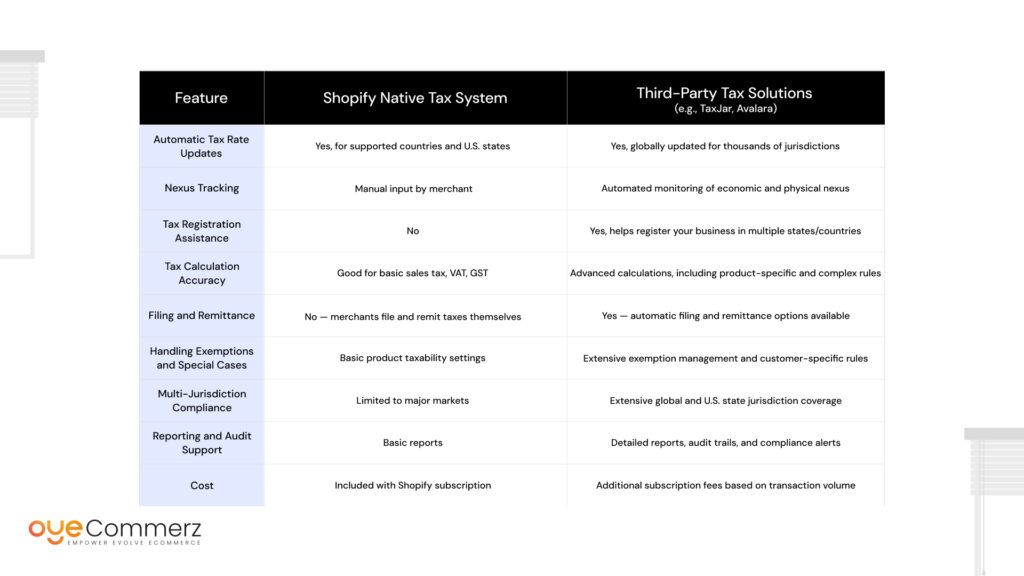

Comparing Shopify’s Native Tax Features vs. Third-Party Tax Solutions

When managing tax regulations for your Shopify store, choosing the right tools can make a significant difference in compliance, accuracy, and efficiency. Shopify provides built-in tax features, but many merchants consider third-party tax automation platforms to handle more complex tax scenarios — especially for international sales or multi-state U.S. compliance.

Which Option Is Right for Your Shopify Store?

- Shopify’s Native Tax System is ideal for small to medium stores primarily selling within a few regions, with straightforward tax obligations.

- Third-Party Tax Solutions are recommended for merchants with complex tax responsibilities, such as selling in multiple U.S. states, international markets, or dealing with frequent tax law changes.

By understanding the capabilities and limitations of each option, you can better manage your Shopify store’s tax compliance and avoid costly mistakes related to tax regulations.

Simplify Tax Compliance with Oyecommerz Shopify Migration Services

Navigating complex tax regulations can be a major hurdle when moving your e-commerce business to Shopify, especially if you’re migrating from platforms like Magento, WooCommerce, or Squarespace. Incorrect tax setup during migration can lead to compliance issues, lost revenue, and penalties.

That’s where Oyecommerz comes in. Specializing in seamless Shopify migrations, Oyecommerz ensures that your store’s tax settings are properly configured from day one—saving you time, reducing risks, and setting your business up for smooth international and domestic sales.

Why Choose Oyecommerz for Your Shopify Migration?

- Comprehensive Tax Regulations Setup: We help configure Shopify’s tax settings tailored to your business locations, sales channels, and product categories.

- Nexus and Tax Jurisdiction Expertise: Our team understands U.S. and international tax obligations, ensuring your store complies with regional requirements.

- Custom Solutions for Complex Tax Needs: If you require advanced tax features or third-party tax integrations, we assist with the setup and testing.

- Minimize Downtime and Data Loss: Our migration process is designed to retain your historical tax data and ensure accuracy during the transition.

- Ongoing Support and Maintenance: Beyond migration, Oyecommerz offers Shopify maintenance services to keep your tax settings and store operations up-to-date.

Take the Stress Out of Tax Compliance

Migrating to Shopify offers tremendous growth opportunities, but ignoring the intricacies of tax regulations can put your business at risk. Partnering with Oyecommerz means you get a migration partner who prioritizes compliance, accuracy, and your peace of mind.

Visit Oyecommerz Shopify Migration Services today to learn how we can help you expand globally while staying fully compliant with all tax regulations.

Contact to Migrate your Site to Shopify Now

Conclusion

Successfully navigating tax regulations is a critical component of growing and sustaining a profitable Shopify store, whether you are selling locally or expanding internationally. From understanding the basics of sales tax and VAT to leveraging Shopify’s built-in tax tools and advanced third-party solutions, staying compliant requires continuous attention and proactive management.

Ignoring or underestimating tax obligations can lead to costly penalties, disrupted customer experiences, and business setbacks. However, with the right knowledge, tools, and support—like the expert migration and tax compliance services offered by Oyecommerz—managing these complexities becomes far more manageable.

By investing time in setting up your tax configurations correctly and regularly reviewing changes in tax laws, you ensure your Shopify store remains compliant, trustworthy, and positioned for long-term success.

If you’re considering migrating to Shopify or need assistance optimizing your tax setup, don’t hesitate to reach out to Oyecommerz for expert guidance tailored to your business needs.

Frequently Asked Questions

International tax on Shopify primarily refers to VAT (Value Added Tax), GST (Goods and Services Tax), and other indirect taxes that apply when selling goods to customers in different countries. Shopify can automatically calculate these taxes based on the customer’s location but does not handle registration or filing.

Yes, Shopify supports international selling with multi-currency and multi-language options, plus automatic tax calculations for many countries. However, you must comply with local tax regulations, shipping rules, and customs requirements.

Duties are tariffs imposed by governments on imported goods, taxes refer to sales, VAT, or GST charged on products or services, and fees may include customs handling or processing charges. These can impact your pricing and shipping costs for international orders.

The de minimis rule is a threshold below which imported goods are exempt from duties and taxes. This varies by country; for example, the U.S. currently exempts goods valued under $800. Shopify merchants need to consider this when pricing and shipping internationally.

To ensure compliance, configure Shopify’s tax settings correctly, stay updated on country-specific tax laws, register for VAT or GST where required, and consider using third-party tax automation tools or expert consultation to manage complex obligations.